Home Depot: 4 Reasons Why I Am Buying

Summary:

- Home Depot leads the MRO market with a 24% market share, benefiting from a strong brand, cost advantage, and acquisitions that broaden product offerings and relevance in the professional customer segment.

- Home Depot’s extensive network and scale provide substantial cost advantages, enabling the company to offer customers everyday low pricing and maintain a competitive edge in the market.

- Shares are currently trading at a 17% discount, providing an appealing entry point for investors, based on a DCF valuation using a 7.2% cost of capital.

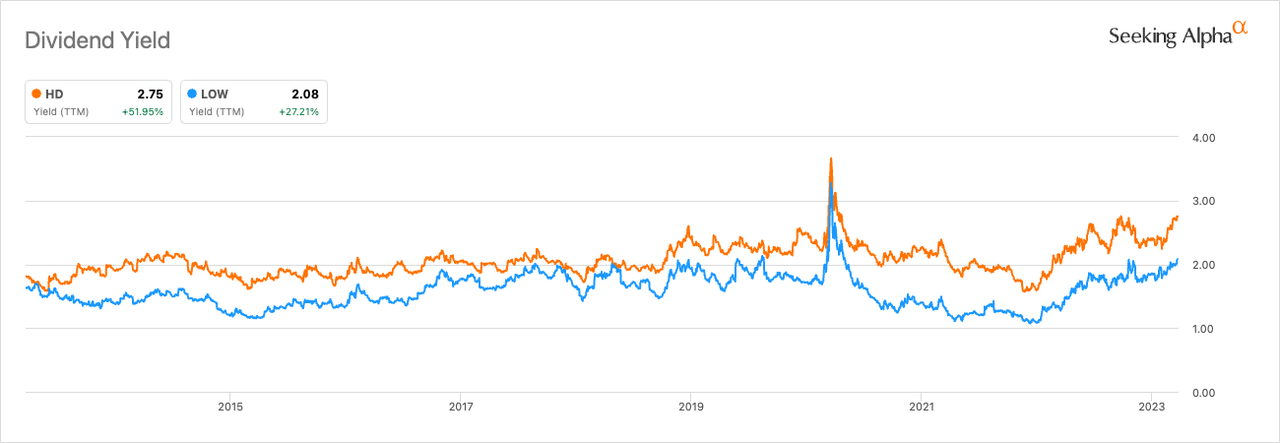

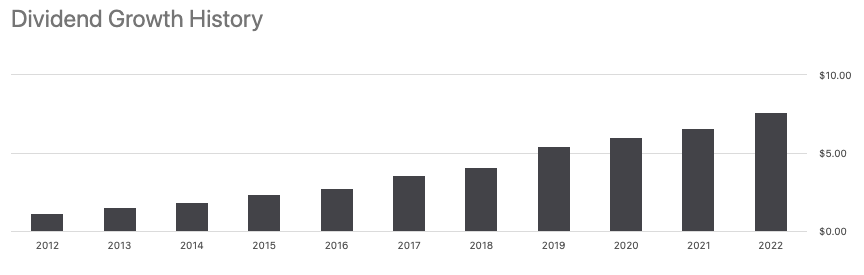

- Home Depot boasts a 13-year history of dividend growth, with a current yield of 2.75%, indicating a safe and potentially increasing dividend in the coming years.

supersizer/E+ via Getty Images

In this article, we will explore four key reasons why The Home Depot (NYSE:HD) shares represent an excellent investment opportunity in the home improvement industry. We will discuss HD’s leadership position in the market, its effective everyday low pricing strategy driven by cost advantages, the attractive valuation of its shares trading at a 17% discount, and its impressive 13-year history of dividend growth. HD’s wide economic moat, strong brand reputation, and expansive scale sets HD apart from its competitors and position it for sustained growth and profitability.

Reason #1: Leader in its market

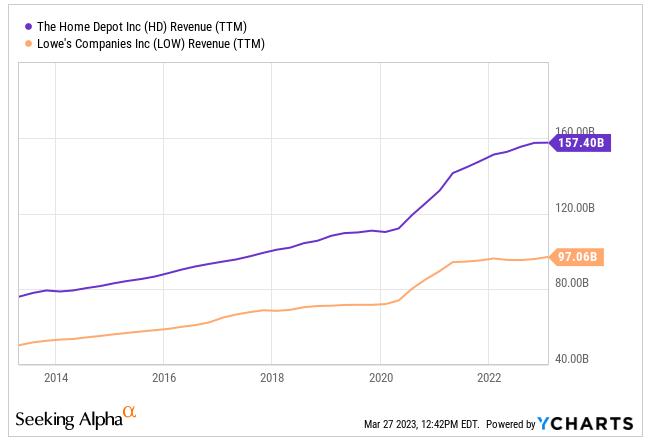

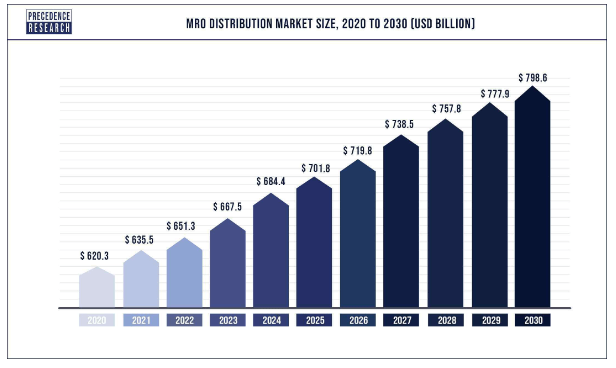

HD leads the $650 billion maintenance, repair, and operations (MRO) market, commanding a 24% market share, while Lowe’s holds 15%.

Ycharts

HD’s success is primarily due to its strong brand and cost advantage. HD’s recent $1 billion investment in frontline hourly workers demonstrates its commitment to employees, enabling them to provide reliable services and maintain top-of-mind awareness for customers, further strengthening its brand. Acquisitions such as Interline Brands and HD Supply have broadened product offerings and increased relevance in the professional customer segment. The MRO market presents a lucrative opportunity for HD to expand its pro customer base and average ticket sales. This market is expected to grow at a 2.6% CAGR through 2030.

Precedence Research

By catering to professional customers through its Pro Xtra program, HD encourages customer loyalty and differentiates itself from competitors.

Reason #2: Effective everyday low pricing strategy driven by HD’s cost advantage

HD’s extensive network of more than 2,300 stores across the US, Canada, and Mexico has allowed it to manage large volumes of merchandise and target specific markets effectively, providing HD with a substantial cost advantage.

Ycharts

The firm’s size facilitates substantial bargaining power with vendors when it comes to sourcing products, advertising, and logistics. The strong relationships HD maintains with vendor partners are difficult for competitors to replicate, considering the market landscape and the resources required to scale up to a level where similar vendor pricing can be achieved.

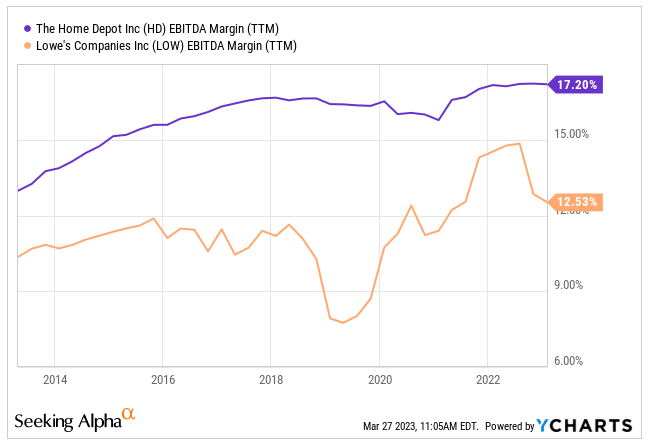

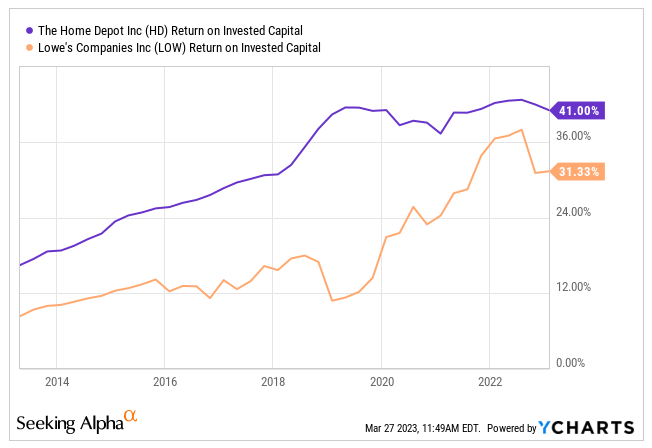

This has allowed HD to outpace the returns of its main competitor, Lowe’s (LOW).

Ycharts

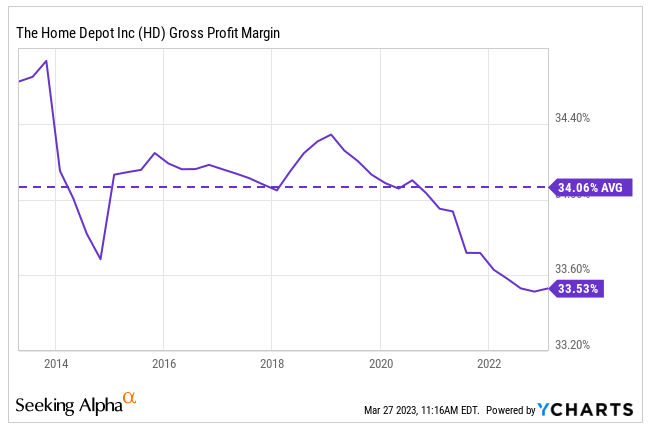

HD’s capacity to secure favorable deals with suppliers empowers HD to offer a part of these savings to customers through its everyday low pricing approach. The everyday low pricing strategy stems from HD’s negotiation power due to its extensive scale, facilitating bulk purchases and influencing the pricing mechanism. This method initiates a virtuous cycle, as customers are drawn back to HD for its value proposition, subsequently driving further scale advantages. The consistent gross margins between 33.5% and 34.5% imply that HD is inclined to pass on any scale-related benefits directly to consumers, making it challenging for smaller retailers to compete with HD’s market dominance.

Ycharts

Reason #3: Shares are trading at a 17% discount

I estimate HD’s share value at $336 based on a DCF valuation, using a 7.2% cost of capital derived from an unlevered beta of 1.19 for the industry.

Recently, HD warned of a potential slowdown in demand for home improvement products this year, mainly due to inflation’s impact on consumers’ ability to spend on remodeling projects. Furthermore, HD anticipates its annual profits to fall short of Wall Street’s expectations as it faces several challenges, including allocating $1 billion towards wages to address labor shortages and managing rising costs.

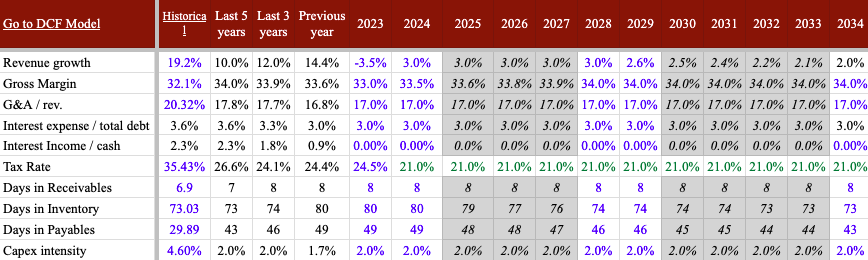

For 2023, I expect revenues to decline by 3.5%. Given the maturity of the domestic home improvement industry, I project a 3% increase in revenues in the medium term.

In terms of margins, I anticipate an 80 basis point decline, consistent with management’s 2023 guidance. Over the next decade, I predict a 100 basis point expansion in gross margins, while the SG&A expense ratio stays flat at 17%. This demonstrates HD’s capacity to capitalize on its scale and supply chain improvements while investing to maintain its market leadership position. The primary assumptions are as follows:

Author estimates & company filings

Reason #4: 13 years of dividend growth currently yielding 2.75%

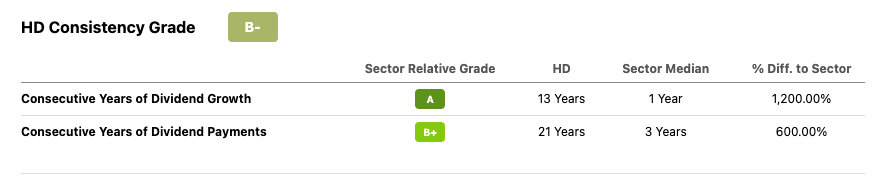

HD has consistently increased its dividend for the past 13 years.

Seeking Alpha Seeking Alpha

Historically, HD’s yield has been 50 to 70 basis points higher than Lowe’s, with the current dividend yield at 2.75%.

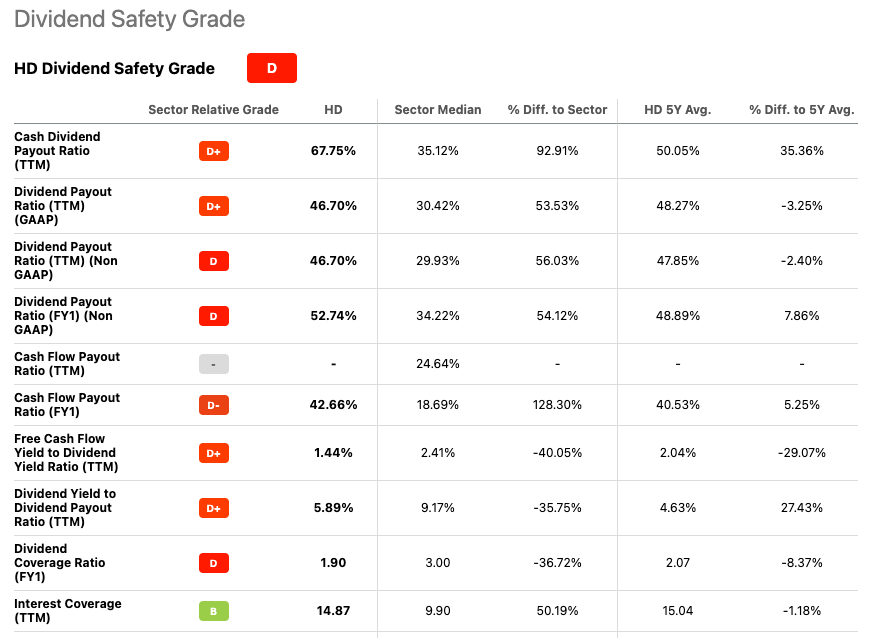

Although Seeking Alpha rates the dividend safety as a D, I believe the dividend to be very safe. I anticipate medium-term free cash flow (operating cash flow minus capex) to range between $12 billion and $18 billion, while the dividend costs HD $7 billion. In fact, I expect the dividend to continue increasing in the coming years, consistent with its 13-year history of dividend growth.

Seeking Alpha

Conclusion

HD presents a compelling investment opportunity in the home improvement industry, with its robust brand reputation, and considerable scale, providing a solid foundation for enduring success. HD’s strategic investments in its workforce and professional customer segment, along with its cost advantage and strong vendor relationships, differentiate HD from its competitors. As the leading home improvement retailer in the US, HD remains focused on operational efficiency, market penetration, and customer loyalty, positioning it for sustained growth and profitability. Currently, HD shares are trading at a 17% discount, offering an attractive entry point. Moreover, HD has a track record of 13 years of dividend growth and a current yield of 2.75%. Based on these factors, I recommend buying the shares.

Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.