Summary:

- AT&T is in the midst of its 5G buildout but has managed its profitability margins relatively well. Hence, we don’t think a dividend cut is a significant risk.

- However, investors will likely account for a considerable discount for a worse economic recession and AT&T’s past missteps in its execution.

- While T doesn’t seem overvalued, investors will need high conviction over its infrastructure spending, given its high net debt.

- Therefore, buying a piece of T is only attractive at the right valuation. And now’s not the time.

Brandon Bell

AT&T Inc. (NYSE:T) stock has gone “nowhere” since its earnings release in January, as investors parse the company’s ability to navigate a potential economic recession.

Moreover, T fell more than 12% (in price-performance terms) toward its March lows as sellers attempted to force a re-test of its previous December bottom. However, buyers returned to stanch further downside, likely seeing value in its stock price.

But does it make sense for buyers to see value at its March lows?

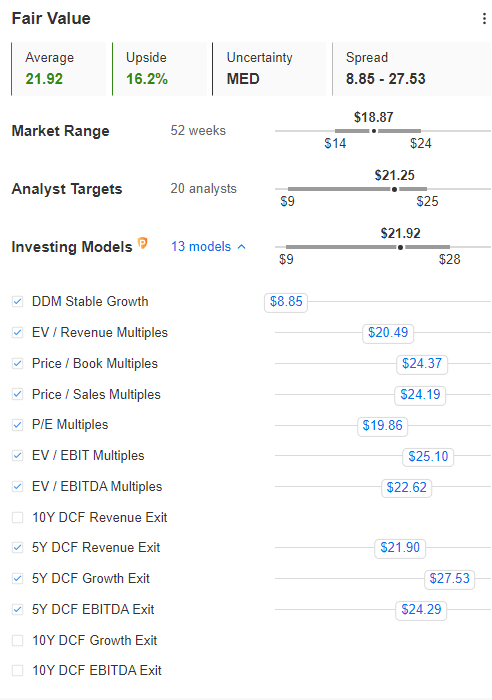

T blended fair value estimates (TradingView)

T’s blended fair value estimate screens relatively well across most models, averaging about $21.9. It implies a more than 20% undervaluation from March’s lows, which could have attracted these buyers to return.

However, with T still seemingly undervalued, why has it faced resistance from sellers at its recent January highs when it wasn’t even overvalued?

We believe investors must consider the significant risks of a potentially damaging economic recession that could scupper the plans of AT&T’s transition.

The company’s free cash flow, or FCF, is expected to remain healthy through FY24. Accordingly, analysts expect AT&T to post FCF margins of 13.5% in FY23 and 14.5% in FY24. As such, we don’t think that the company’s dividends are at risk.

Based on its FY23 projections, its dividend payout ratio (based on adjusted EPS) is expected to be about 46%. Therefore, it seems well covered.

Hence, income investors have likely found solace in its NTM dividend yield of 6%, which is much higher than the market’s average of 4.7%.

As such, finding a floor at T’s March lows seems credible. But, for investors who missed the recent opportunity, should they consider buying the recovery?

We believe the market remains optimistic about the company’s ability to steer its P&L despite its net debt of about $160B. In addition, we observed that its interest expense has continued to fall over the past few quarters.

Accordingly, AT&T reported a TTM interest expense of $6.11B in FQ4’22, down from FQ2’s $6.55B and FQ3’s $6.34B. Furthermore, the company proved its ability to achieve its cost savings target in FQ4, as COO Jeffery McElfresh articulated in a recent conference:

We announced in the fourth quarter that we had achieved over $5 billion of the $6 billion cost takeout target. If you think about the actual carrying cost of an underutilized copper network that is across 511,000 square miles, think about all the access circuits. You think about all the maintenance and support. You think about all the energy that we use. We are in the early innings of that wireline transformation. And so over the next 2 to 3 years, you will see us draw costs out of this part of our franchise, reinvest them into the future of the company, and it should be a nice virtuous cycle of great returns for investors. (Morgan Stanley Technology, Media and Telecom Conference)

Hence, it’s clear that management believes that it’s still in the midst of building its infrastructure. However, as it scales, it should lead to better operating leverage that could be used to drive further efficiencies and improve the ROI for investors.

Therefore, investors buying into AT&T’s buildout are likely looking toward its ability to use its scale to defend its market leadership and profitability against its arch-rivals T-Mobile (TMUS) and Verizon (VZ).

As such, while AT&T is not immune to higher risks of a downturn in consumer discretionary spending, its focus on “high-quality subscribers” should help to defend against a worse economic fallout.

Moreover, growth projections are pretty tepid, as analysts expect a 1.5% topline growth in FY23 and 1.2% in FY24. As such, the market isn’t expecting AT&T to post significant growth over the next couple of years, which helps to lower slowdown risks emanating from a recession.

Given the company’s robust FCF metrics, we believe the investors will likely focus on its execution risks through its transition. However, given its past misjudgments, investors are right to be aggrieved about its capital allocation strategies which “have destroyed shareholder value and the firm will pay the price for these missteps for some time to come.”

Hence, accounting for a considerable discount against its blended fair value estimates against these headwinds is justified.

Therefore, we urge investors to remain patient as the company navigates a challenging macro environment, coupled with its 5G buildout. We highlighted a significant opportunity to jump into T back in October as fear gripped investors.

That thesis has played out accordingly, but T’s valuation normalized quickly as astute investors capitalized on fleeing panic sellers.

If you have not added any exposure, consider watching the action from the sidelines.

Rating: Hold (Reiterated).

Important Note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Spot a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree, comment and let us know why, and help everyone to learn better!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!