Abbott Acquires Cardiovascular Systems: Key Takeaways For Investors

Summary:

- Abbott Laboratories expands its cardiovascular pipeline with the relatively small acquisition of Cardiovascular Systems, Inc.

- Cardiovascular Systems investors get a way out of a cash-burning stock at a decent price. The timing of the deal is opportunistic for Abbott.

- Abbott offers a strong growth path of 8%+ organic growth over the next couple of years. This acquisition doesn’t change that view immediately.

ipopba

Abbott Laboratories (NYSE:ABT) is a healthcare growth company with an excellent track record. It showed strong and profitable growth in the past. Cardiovascular Systems, Inc. (NASDAQ:CSII) opens up new growth paths for Abbott.

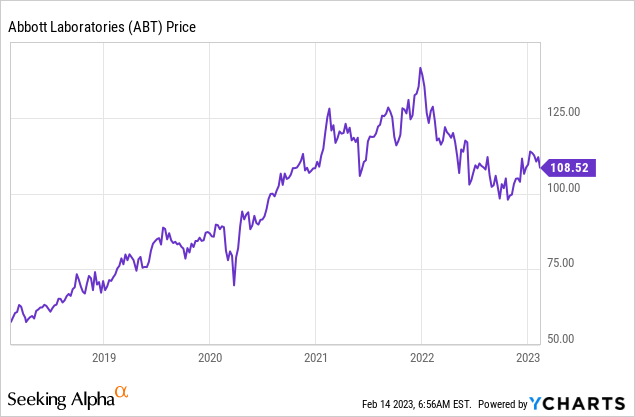

Abbott’s shares can use a new catalyst as the covid testing boom faded. The company keeps making more money on these tests as expected, but it’s a cash cow that will almost certainly end soon. The market anticipated this near-term headwind. Murphy is always nearby when things go wrong, and forex was another setback in 2022.

I already mentioned in November that an acquisition could incite new market interest in Abbott’s shares. This acquisition doesn’t immediately light up the share price. It should deliver value in time. It fits Abbott’s strategy of building on its four divisions with steady overall growth.

The Basics Of The Acquisition

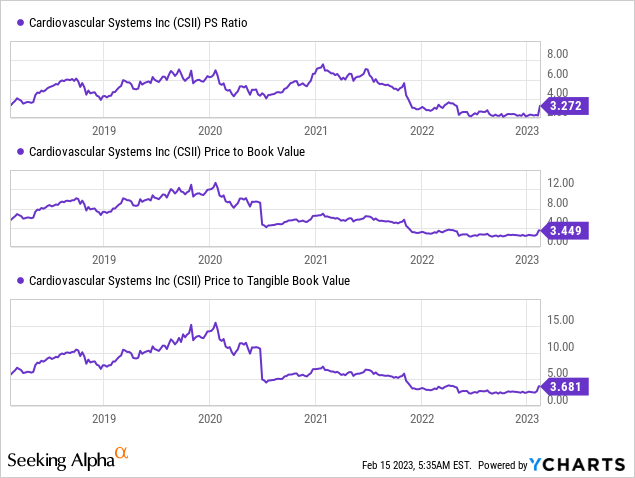

Abbott offers $20 per share, or $890M for Cardiovascular Systems. It’s about 3.7 times sales and 3.5 times book value. CSII is unprofitable and has negative EBITDA, so these are the only valuation measures available.

The ~50% premium to the last share price is probably enough to convince shareholders. CSII did trade at much higher levels before, so the offer from Abbott seems opportunistic.

The $240M annual revenue won’t move the needle for Abbott. The value is mainly in the future potential of CSII’s products.

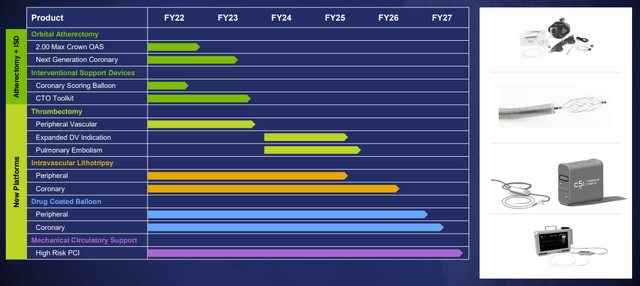

Investor Presentation (Cardiovascular Systems)

CSII’s most significant innovations are still a couple of years out. Its intravascular lithotripsy system should deploy in 2025 and the drug-coated balloon should launch in 2027.

That’s probably why the market assigned such a low value to CSII’s pipeline. In Abbott, they will get the time and care to develop nicely. Abbott’s experienced management reduces the execution risks for these promising developments.

The deal is reasonable for CSII investors. The upside potential is far in the future. The company could even need additional cash to bridge operations until the launch of new products. The market isn’t patient with cash-burning companies anymore. The deal with Abbott fixes this. It pays a good premium over the recent share price.

The valuation of CSII shows the deal is opportunistic. The valuation is well above the valuation in most of 2022 but far below CSII’s previous valuation levels.

Abbott’s Growth Path

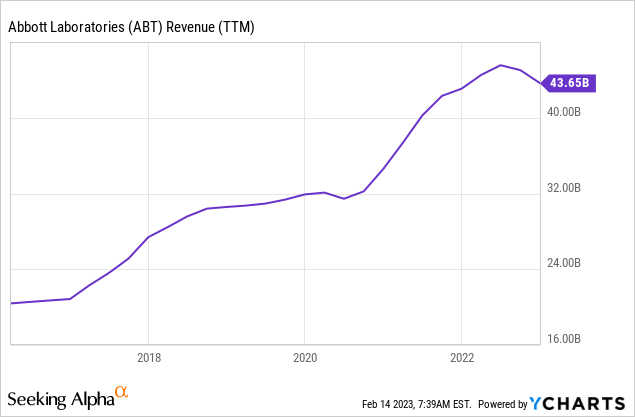

Abbott’s revenue jumped during covid due to its covid sales. Covid testing made up $8.37B of last year’s revenue. The good news is that it also hides a strong growth beyond its covid tests. 2022 revenue without covid tests was $35.29B, or grew at a 3.4% CAGR since 2019. It’s below its past growth rates of 6% to 8% annually, which is due to currency changes and probably also some lost focus that went to covid tests.

Growth Outlook

In 2023, the base expectation of Abbott is that revenue and EPS will drop. The covid testing boom is over and will leave a gap of $6B in revenue and about $1 in EPS. That leads to the guidance of 18% lower EPS. It expects high single-digit organic growth without covid and not taking into account currency changes.

Past growth doesn’t ensure future growth (although it’s an important indication).

What can we expect from Abbott in the next couple of years?

As the CEO, Ford put it on the earnings call:

[…] without the COVID testings, we are going to be growing high single-digits, probably at a higher end of that pre-pandemic range probably 8% plus.

The positive outlook makes sense, as many of Abbott’s end markets are growing fast. Diabetes care, nutrition, and vascular are growth markets.

Abbott’s Current Valuation Is Reasonable

The news of the acquisition doesn’t change much to Abbott’s current valuation. It has enough available cash or could raise debt without significantly increasing its leverage.

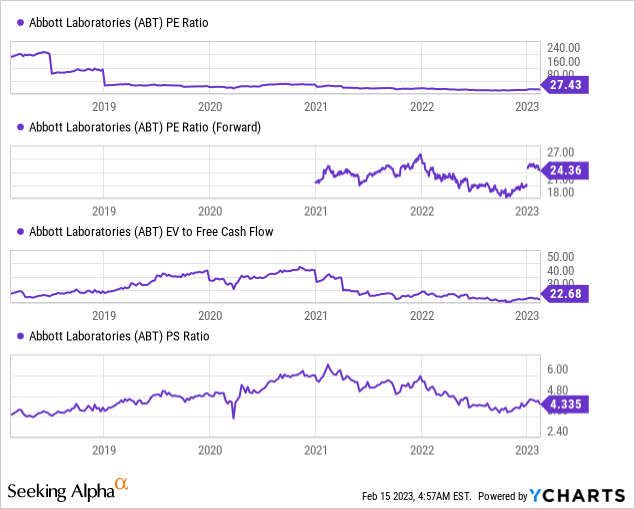

Abbott is reasonably valued to its historic ratios. The P/S and EV/FCF ratios came down recently. Forward P/E increased due to an expected drop in EPS in 2024. I see a good possibility that Abbott beats these expectations, just like it did for the past eight quarters.

Risks

The deal still has to close, and while there is a large likelihood it goes through, there is always a small risk it fails. I believe this wouldn’t change much for Abbott. CSII would probably fall back to the share price before the deal. That’s obviously why there is a small arbitrage opportunity as it trades 1.6% below the deal. The arbitrage gap is rather small if you keep in mind it still takes time to close the deal. I haven’t encountered an exact timeline for the deal.

For Abbott, there is also the issue with its baby formula. Its plant had to close for several months in 2022 due to several issues such as bacterial contamination. It restarted in June. Abbott is now under investigation by the U.S. Justice Department.

Conclusion

Shareholders of Cardiovascular Systems, Inc. get an easy way out of the stock that’s burning cash. It’s not at the high levels the stock once traded, as the hope of quick gains faded, and there could even come questions of cash-raising in the next couple of years. That makes it probably a bitter pill to swallow for long-term stockholders.

Abbott Laboratories gains a nice set of new patents and programs that perfectly fit its existing portfolio. The company has plenty of cash and low leverage, with room for more debt. It’s a small acquisition for Abbott that builds further on its existing strengths. CSII doesn’t change much on Abbott’s current outlook. It does strengthen my belief in the possibility of Abbott creating value in the long run.

Abbott Laboratories remains a strong medical device company with a strong track record. It’s a dividend aristocrat with a fast-growing dividend that deserves a place among other dividend-growth stocks.

Disclosure: I/we have a beneficial long position in the shares of ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Any investments you would take after a piece or discussions with me are your responsibility. Please do your own due diligence before an investment.