Summary:

- Abbott has had a crazy couple of years, with a formula recall and a COVID testing boom.

- Through this year, most of that should start to normalize, and the Libre 3 launch and growth in the diabetes market should remain a long-term tailwind for the company.

- Abbott is a fine hold for dividend safety, but I’d prefer to look elsewhere.

Nathan Howard

Abbott Labs (NYSE:ABT) is in a tough spot to analyze, with a lot of moving parts. The company was at the center of a boom in COVID testing, faced a formula recall at the end of last year, and recently launched its Libre 3 continuous glucose monitor. There’s a ton of give-and-takes in the business, but the company is positioned to continue to reliably grow the dividend, provide returns relatively in-line with the market with smaller drawdowns, and allow investors to sleep well at night.

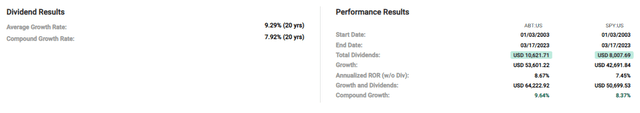

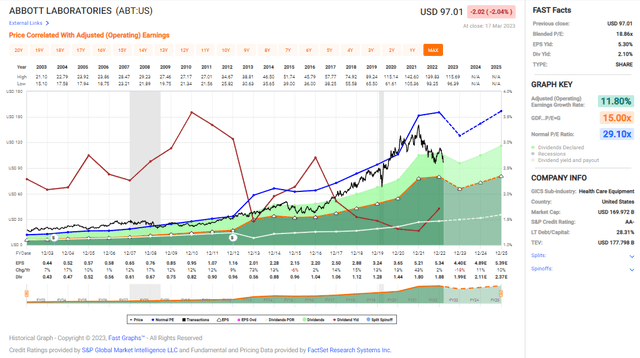

Abbott has managed market-beating returns over the past two decades. Its position in healthcare and relatively moaty markets has resulted in a calmer path along the way, as well. There have been a lot of shifts in the business over that time. The split with AbbVie (ABBV) removed most of the company’s biotech exposure along with the sale of developed markets pharmaceuticals. The company maintains branded generics sales in emerging markets, which should prove to drive solid growth. The company has also tacked on medical device companies pretty frequently, notably including the $25B purchase of St. Jude Medical and its heart-focused portfolio in 2017.

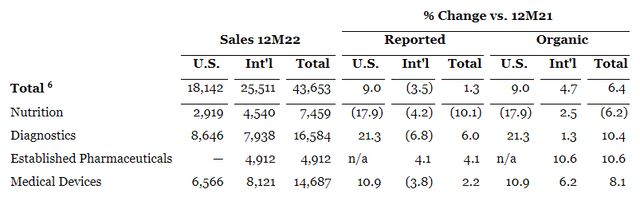

However, for a conservative company like Abbott, it has been a crazy couple of years. The company has begun reporting sales figures excluding the impact of its COVID testing sales, which seems appropriate. Management projects COVID tests will end up in a similar spot to the company’s flu, RSV, and strep portfolio with occasional variants but ultimately fewer and fewer major outbreaks over time. In 2022, the company sold 3B COVID tests, and projects 2B in 2023. Ex-COVID, diagnostics grew 11% on strength in rapid diagnostics. This is impressive growth, and very good to see the rest of the segment is continuing to perform well regardless of the decline in COVID tests.

Excluding COVID and the formula disruption, organic sales rose 7.1% in 2022. However, in the most recent quarter, the Nutrition segment containing baby formula was down 6%. The problem could linger longer than anticipated. New parents buy baby formula off the brand name, and are highly sensitive to potential dangers when feeding their infants. Similac has world-leading brand equity, but recalls like this one are not good to see as an investor. The recall was a major contributor to the formula shortage last year, and has drawn a DOJ investigation of the Sturgis plant to determine root causes. The company is working through restoring inventories now, so barring any unforeseen issues we can look ahead to normalization this year. Overall, baby formula should maintain steady growth rates over time in emerging markets as a play on the rising global middle class.

Established pharma grew 8% in the quarter and 10% on the full year, with emerging markets again representing a solid growth vector. Emerging markets are difficult to operate in typically, and Abbott has successfully navigated its way through and dealt with the cultural differences in healthcare infrastructure and often less mature distribution networks.

Medical devices grew 7.5% on strength in structural heart and diabetes. Abbott has acquired its way into the cardio market over time, but the medical device field can be difficult considering the difficulties in staying ahead of competition. It requires high investment into R&D and plenty of operational skills in navigating approval pathways and relationships with providers. The brightest spot here, and likely the lynchpin of an investment thesis rests with the FreeStyle Libre continuous glucose monitor. It has grown into around 10% of Abbott revenues today and grew 40% this past year to $4.3B in global sales. Management sees the newest iteration, the Libre 3, as a $10B a year product, and as I discussed in my article on key competitor Dexcom (NYSE:DXCM) that the diabetes market is an excellent one to invest in. The Libre 3 will compete directly with the Dexcom G7 and Medtronic’s Guardian CGM. Abbott has closed the technology gap with Dexcom with its insulin pump integrations, and for the most part competition between the two and Medtronic (NYSE:MDT) will come down to certain features, much like smartphones. Recent approvals have opened the doors for reimbursements for Type 2 patients, which drastically increases the addressable population from around 8.4M to around 462M. Diabetes is sadly a quickly growing issue globally, and Abbott is well positioned to continue to land-grab in what is a relatively greenfield opportunity. However, switching costs remain relatively non-existent, and as new iterations launch, there are fewer differentiators between the competitors in the space. Once the market approaches saturation, it’s likely they will begin to compete on price and that will be a drag on profitability. That’s years away, but it bears consideration.

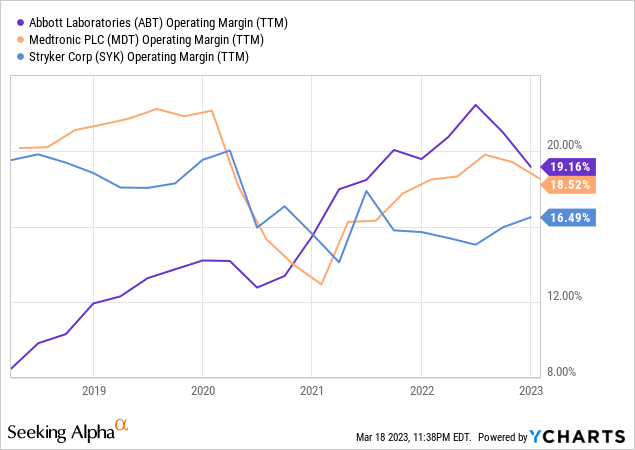

Abbott’s operating margins have been pointing the right direction until declining this year. I’d anticipate further declines back to normalcy as COVID testing abates. Abbott has historically not been up to par compared to a company like Medtronic in terms of profitability. However, the potential is there. Medical devices, diagnostics, and baby formula are not low-margin business lines. It does seem like Abbott’s focus on emerging markets could be to blame, and management has taken steps to invest in improvements, most notable the joint venture with New Zealand’s Fonterra on a dairy hub in China. This would lower input costs for formula manufacture closer to emerging end-markets.

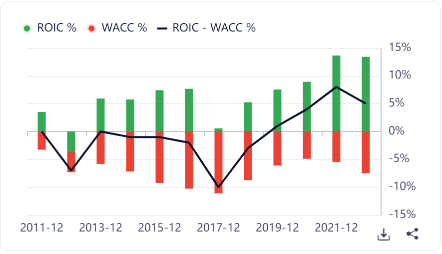

GuruFocus

Abbott’s returns on invested capital are nothing to write home about. It outpaces the weighted average cost of capital, but using GuruFocus calculated figures, as recently as 2017 and 2018 the ROIC-WACC spread was negative. Additionally, buybacks in 2020 and 2021 directly into the COVID boom were value destructive. It’s not atypical for Abbott to go out and acquire its way into additional medical device markets, and ROIC is a good way to measure how well those decisions were made.

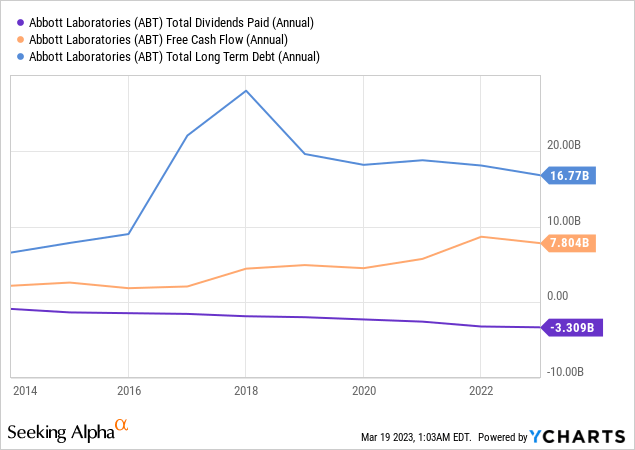

The company’s balance sheet is in a good spot. Abbott has long been a DGI powerhouse, averaging 12% dividend growth over the past 5 years. The dividend is well covered by free cash flows, and so is the debt. I’d anticipate no issues in continuing to grow the dividend over time.

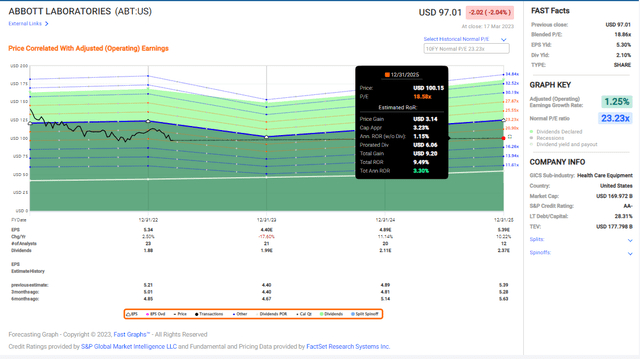

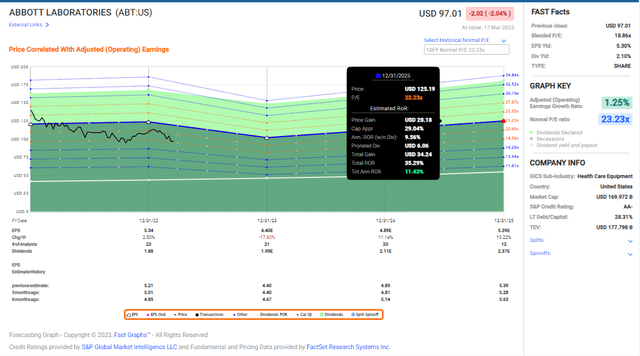

Earnings have increased very consistently over time and look to be returning back to the long-term trajectory coming off the COVID boom. The company is below its long-term valuation but trading relatively in-line when looking at the more recent history.

Based on analyst estimates for earnings growth and maintaining the current valuation, an investment today could yield around 3% annualized total returns over the next few years, with 2% of that coming from the dividend.

In a more bullish case, a return to the long-term valuation of 23X earnings could net around 11.5% annualized total returns, with a good portion of that coming from multiple expansion. Earnings are expected to decline this year, and as COVID testing starts to roll into a more mature market, they should begin climbing steadily again.

In all, I’m not excited about an investment in Abbott. I think it will do fine over the next decade, probably mimicking market returns or beating them slightly. However, I assess the best aspect of the company currently is the Libre, and you can buy a pure-play version of that in Dexcom. For dividend safety, you can’t beat Abbott, but there’s definitely some question marks for me. Poor ROIC, the recall of baby formula, and historically lower operating margins than peers will keep me away. It’s a hold, and I do think it’s a fine company to own for the dividend safety.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.