Summary:

- Abercrombie & Fitch released its Q1 results last month, managing to grow sales year-over-year despite difficult comps related to lapping government stimulus and contending with China lockdowns.

- However, while sales performed well, the company did see meaningful margin compression, impacted by the accelerated sell-through of holiday inventory and higher material/freight costs.

- This led to the company taking its FY2022 operating margin outlook down from 5-6% vs. 7-8% previously, setting the company up for a significant decline in earnings year-over-year.

- At 9.3x FY2022 earnings estimates, much of the negativity around a potential pullback from consumers looks priced into the stock, but I still don’t see enough margin of safety just yet.

It was a rough Q1 Earnings Season for the Retail Sector (XRT), with companies reporting weaker than expected sales or softer margins and, in some cases, a mix of both, having to lap sales leverage from governments stimulus (Q1 2021). While Abercrombie & Fitch (NYSE:ANF) managed to post respectable sales performance, its margins did take a hit, as did its FY22 margin outlook, sending the stock to new 52-week lows. After a 60% correction, some investors might be anxious to rush into the stock. However, while cheap at 9.3x FY2022 earnings estimates, I don’t see enough margin of safety just yet.

anouchka/iStock Unreleased via Getty Images

Abercrombie & Fitch Brands (Company Presentation)

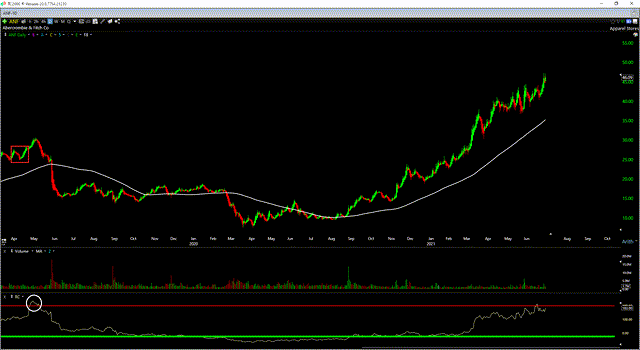

Just over eleven months ago, I wrote on Abercrombie & Fitch (“Abercrombie”), noting that while it continued to report solid results, the stock looked fully valued, and the stock was stretched short-term. This is because it was sporting a similar overbought reading to April 2019 and was up more than 480% from its COVID Crash lows in March 2020. Since then, the stock has slid nearly 60%, impacted by higher material and freight costs which have weighed on margins, and worries about how sales will hold up in a highly inflationary environment. The good news is that with the stock down 60%, some of these negative development looks priced into the stock. Let’s take a closer look below:

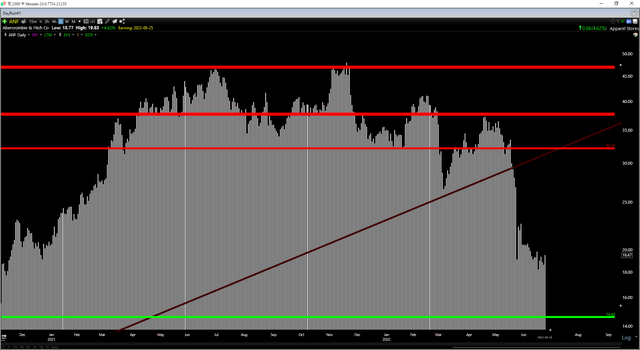

ANF Daily Chart – June 2021 (TC2000.com)

Q1 Results

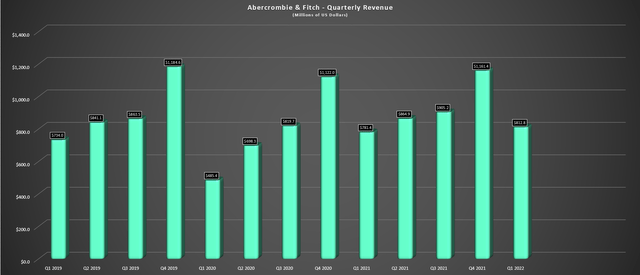

Abercrombie released its Q1 results in late May, reporting quarterly revenue of $812.8 million, a 4% increase from the year-ago period. This was a satisfactory performance given the China lockdowns, which impacted international sales, combined with the fact that Abercrombie had to lap blockbuster Q1 2021 results, aided by government stimulus. As shown in the below chart, this performance was helped by the 8th consecutive quarter of higher average unit retail [AUR] at Abercrombie, and the highest Q1 AUR in the brand’s history, pushing sales well above Q1 2019 levels.

Abercrombie & Fitch – Quarterly Revenue (Company Filings, Author’s Chart)

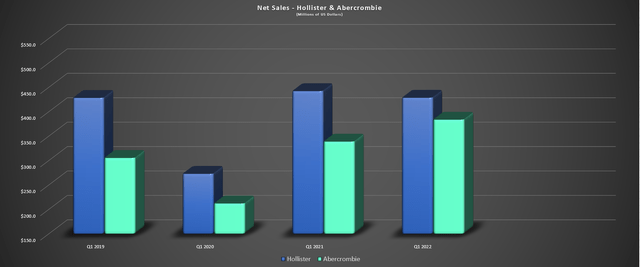

Abercrombie & Fitch – Net Sales by Segment (Company Filings, Author’s Chart )

In addition to the strong sales performance at Abercrombie, the company followed American Eagle’s (AEO) footsteps, launching its first line of activewear called Your Personal Best. This new line includes leggings, shortages, tanks, and gym bags for men and women and hopes to capitalize on the growing albeit competitive activewear market, estimated at ~$500 billion by 2027. Abercrombie noted in its Q1 results that sales in this new line have been encouraging to date, and prices are quite reasonable ($29 – $100), below category leaders like Lululemon (LULU).

Abercrombie & Fitch Outfits (Abercrombie & Fitch Social Media)

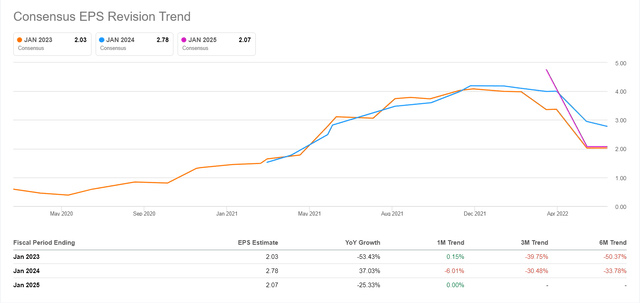

Unfortunately, the good news of the activewear launch and the solid sales performance out of its larger Abercrombie segment were overshadowed by margin softness. This was evidenced by a more than 800 basis point dip in gross margins on a year-over-year basis (55.3% vs. 63.4%). Worse, we saw a significant haircut in the FY2022 outlook, with the previous guidance of 7-8% operating margins trimmed to 5-6%. Not surprisingly, this led to negative earnings revisions, with Abercrombie expecting freight and materials costs to remain elevated in the near term.

Abercrombie & Fitch – Earnings Revisions (Seeking Alpha)

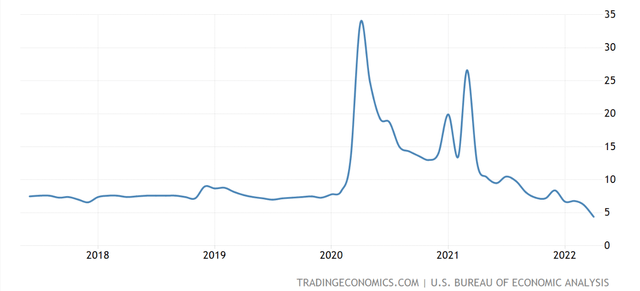

The other negative development which has created some uncertainty is what the impact could be from a much weaker consumer. This is related to higher mortgage payments, higher gas prices, and general inflation, all contributing to shrinking discretionary budgets and the potential for a shift to off-price retail shopping for some consumers. Notably, this dent in discretionary budgets is occurring at the same time as the personal savings rate for US households has plunged to multi-year lows (May: 4.4%).

US Personal Savings Rate (TradingEconomics.com, US Bureau of Economic Analysis)

Given that Abercrombie has seen an impressive turnaround and remains an iconic brand with fresh momentum in a new line (activewear) and growing AURs, the impact may be less significant than expected. However, the improving AURs could see a minor hit due to a need to be a little more promotional, and traffic could also wane, with a portion of the customer base looking for cheaper alternatives or simply not having room in their budget for wardrobe refreshes this summer. For this reason, names like TJX Companies (TJX) could be a little better positioned within the retail space, potentially benefiting from a trade-down from some retailers. Let’s take a look at Abercrombie’s earnings trend below:

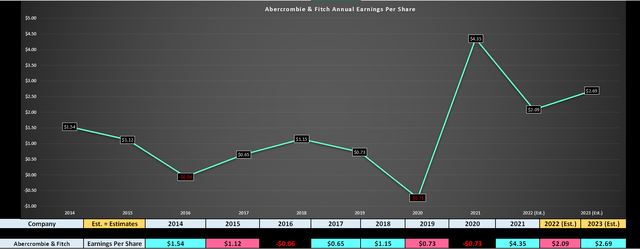

Earnings Trend

Looking at the chart below, we can see that Abercrombie had a phenomenal year in 2021, posting annual earnings per share of $4.35. This was helped by reduced promotional activity across the sector due to pent-up demand following the pandemic and meaningful margin expansion for many retailers. However, looking ahead to FY2022 estimates, annual EPS is expected to slide more than 50% year-over-year, with forecasts curing sitting at $2.09. While this would still represent a more than 70% increase from pre-COVID-19 levels, it would pull annual EPS down below FY2011 and FY2012 levels, translating to zero earnings growth over the past decade.

Abercrombie & Fitch – Earnings Trend (YCharts.com, Author’s Chart, FactSet)

If we compare this to other brands like Lululemon, they have enjoyed a 20% compound annual EPS growth rate in the same period, justifying their premium multiples. Looking ahead to FY2023, current forecasts suggest that Abercrombie could see an improvement in earnings ($2.69), clawing back some of the losses this year and placing annual EPS more than 100% above FY2018 levels. However, the key will be if the Federal Reserve can orchestrate a soft landing or if we end up in a recession. In the latter case, meeting these goals could prove difficult.

During Abercrombie’s recent Investor Day presentation, the company shared that it’s targeting up to $4.3 billion in FY2025 revenue and 8% operating margins, which would justify a higher share price. These targets look lofty, especially given the challenging environment, but they’re not completely unreasonable if momentum can continue in activewear, carving out a new meaningful category for the company. It’s also worth noting that while annual earnings could sag further if consumers pull back, Abercrombie has ammunition to defend its share price and grow annual EPS, with over $250 million left on its buyback program.

Valuation

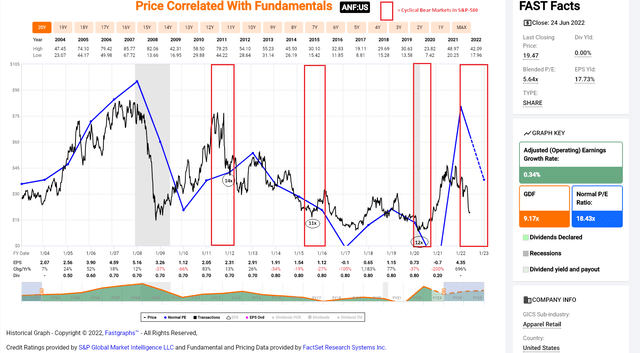

At first glance, with a historical earnings multiple (20-year average) of ~18.4, Abercrombie might appear deeply undervalued at current levels, trading at just 9.3x FY2022 earnings estimates, assuming this sharp year-over-year earnings decline comes to fruition. However, while this historical ratio points to share-price upside, it’s important to note that we typically see a meaningful contraction in multiples during cyclical bear markets for the S&P-500, which is the present case. In fact, Abercrombie has historically traded down to a median earnings multiple of 11x during cyclical bear markets over the past decade (2011, 2015, 2020), suggesting that the stock is not all that undervalued.

Abercrombie – Historical Earnings Multiples during S&P-500 Cyclical Bear Markets (FASTGraphs.com)

Based on a more conservative earnings multiple of 12, which is the stock’s median trough during cyclical bear markets, Abercrombie’s fair value would come in at $25.08, assuming it meets FY2022 annual EPS estimates of $2.09. This translates to a 29% upside from a current share price of $19.50. However, when entering new positions in small-cap names, I prefer a minimum 35% discount to fair value to bake in an adequate margin of safety, especially when the earnings trend is in decline. After applying this discount to fair value, Abercrombie’s low-risk buy zone comes in at $16.30. Let’s look at the technical picture:

Technical Picture

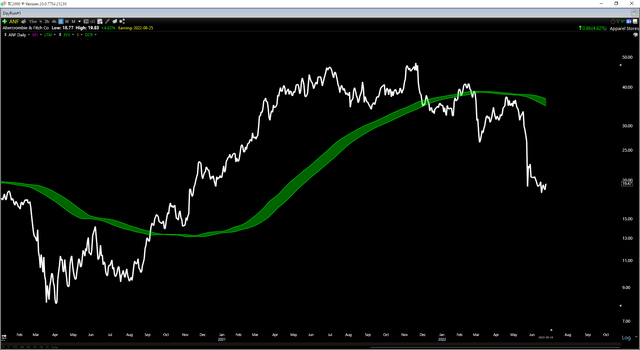

Following the violent Q1 correction, Abercrombie reclaimed its long-term moving averages in September 2020, providing a reason to be optimistic about the stock’s future performance. However, with the stock sinking below its key moving averages (green band) in December of last year, and the slope of these moving averages rolling over, momentum is now to the downside. During these periods, it rarely makes sense to fight price. Instead, the better strategy is to wait for ANF to reclaim this moving average at lower levels or a pullback close to a key support level, suggesting that the correction could be nearing its end.

ANF Daily Chart Momentum (TC2000.com)

Looking at the support and resistance levels below, ANF has strong support at $14.60, which was previous resistance coming out of previous bear markets, and the stock doesn’t have any strong resistance until $32.10 per share, which is its broken 2021 support level (now new resistance). Based on a current share price of $19.50, this translates to a reward/risk ratio for ANF of 2.57 to 1.0. However, when investing in industry laggards, I prefer a minimum 6.0 to 1.0 reward/risk ratio to define low-risk buy zones, and we are nowhere near this level yet. So, unless ANF drops below $17.00, where its reward/risk ratio would improve to just above 6.0 to 1.0, I don’t see any reason to rush in and catch this falling knife.

ANF Daily Chart (TC2000.com)

Summary

There are no guarantees that Abercrombie dips into the $16.30 – $17.00 low-risk buy zone, but when it comes to industry laggards, I believe it makes sense to pay the right price or pass entirely. So, while it may be tempting to buy this 60% off sale, I see the best course of action as being patient for now. This is especially true given the recent guidance cut and the elevated risk with the major market averages trading beneath their 40-week moving averages. Having said that, if ANF were to dip below $16.30 before September, where it would become oversold, I would view this as a buying opportunity.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.