Summary:

- American Tower is a large cell tower REIT with a market cap over $100B.

- With their international footprint, attractive lease terms, and tailwinds for data usage and cell service, American Tower has the potential for continued growth in spite of its size.

- Shares currently trade at a price/FFO of 21.9x, which is slightly below the average multiple.

- The company has provided quarterly raises for a decade, and their 2.9% yield is near the all time highs for the company.

- For dividend growth investors, American Tower is a great company at a fair price.

imaginima

Since the start of the year, markets have rallied strongly with the S&P 500 (SPY) (VOO) up 7% while the Nasdaq 100 (QQQ) is up over 13%. Both have been driven by strong share price performance of the largest tech companies, which are richly valued today. One of my favorite investments that has been left behind by the rally is cell tower REIT American Tower (NYSE:AMT). Shares are basically flat on the year, but I still think now is a good time to be buying shares.

Investment Thesis

American Tower is one of my favorite REIT investments for several reasons. Their international footprint of irreplaceable assets is one. They can lease towers out to multiple tenants, and they have been growing the 2.9% dividend every quarter for a decade since their REIT conversion. I also like American Tower due to the long-term tailwinds for data usage and cell service, which should continue for years to come. They recently have been in the news about a potential acquisition, but those just look like rumors for now, despite American Tower’s acquisitive past.

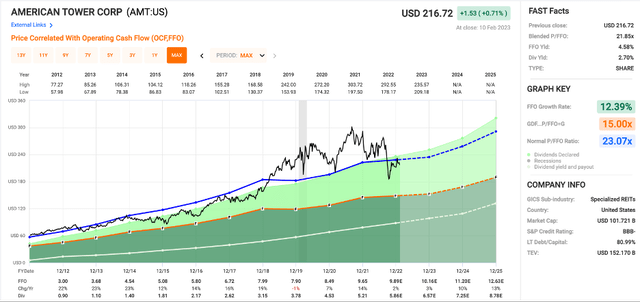

Shares are down significantly from their peak over $300, and I think that provides investors with a good entry point with a reasonable margin of safety. Shares currently trade at a price/FFO of 21.9x, which is slightly below the average multiple of 23.1x. Despite a huge market cap over $100B, I still think the REIT should be able to achieve double digit growth rates in FFO/share in coming years. I think the risk/reward profile of American Tower is attractive, and barring any unforeseen changes, I think investors are looking at double digit returns from here.

Acquisition Speculation

American Tower received some headlines that they are looking to combine with Brookfield (BAM) to acquire Spanish tower operator Cellnex (OTCPK:CLNXF) near the end of January. Several analysts have voiced their skepticism on a potential deal for several reasons, including Cellnex’s leverage and modest organic growth.

A deal for Cellnex by American Tower would also be unlikely after AMT’s management has been “adamant” in recent meetings that it’s not interested in large “platform” deals and its main objective is deleveraging the balance sheet to ~5x,” Wells Fargo’s Luebchow wrote. A Cellnex deal would likely take AMT leverage to ~5.8x and “take it well off its path toward deleveraging.

American Tower has made numerous acquisitions in the past, so it’s not out of the realm of possibility, but rumblings of a Cellnex acquisition just look like rumors for now. With management focused on deleveraging, I doubt we will see any major acquisitions, but we will see how things play out. American Tower’s valuation isn’t dirt cheap today, but I still think it provides investors with an attractive entry point.

Valuation

American Tower has consistently commanded a premium multiple from the market, for good reason. Shares currently trade at a price/FFO of 21.9x, a slight discount to its average multiple of 23.1x. While that might not be considered cheap, I think shares of American Tower represent a high-quality company at a fair price today.

While the FFO/share growth isn’t projected to be all that impressive in 2023, estimates for 2024 and 2025 are expecting double digit growth. While American Tower is a huge REIT with a market cap over $100B, I think they will be able to continue to grow for years to come. The growing demand for data usage and cell service are long term tailwinds that show no signs of slowing, and their international footprint gives them plenty of runway to continue to grow. Another reason that I find the valuation attractive is American Tower’s consistent dividend growth.

A Decade Of Dividend Growth

I have talked about American Tower’s dividend growth in past articles, but their impressive track record of dividend growth is one of the reasons I find the REIT so attractive. Shares currently yield 2.9%, but investors like myself have come to expect quarterly raises, a pattern I expect to continue. The yield isn’t huge today, but it is trading near all-time highs for the REIT. Shares have typically traded in the 2% yield range. The most recent hike was 6.1%, and with all the tailwinds for cell towers and data usage in general, I think American Tower can grow their dividend at double digit rates for years to come.

Conclusion

I have talked in previous articles about why I prefer cell tower REITs like American Tower and Crown Castle (CCI) to investing in telecommunications companies, but I think it’s a point worth reiterating. The towers can have multiple tenants, have impressive returns on capital, and don’t carry overleveraged balance sheets typical of the large telecom companies. The yield might not be as large, but their track records of dividend growth should continue to drive double digit returns for investors. Shares are well off their peak, and I think there is a good margin of safety for investors buying shares today.

I don’t know if shares can be called cheap today, but I think a consistent grower like American Tower has earned its premium valuation. Shares currently trade at a price/FFO of 21.9x, which is slightly below the average multiple. Combined with the growing 2.9% yield, I think investors can expect double digit returns from here. While American Tower has been busy in the past with acquisitions, the rumors of a Cellnex acquisition look like they are just rumors for now. For dividend growth investors looking at American Tower, I think the risk/reward is attractive today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of AMT, CCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.