Eli Lilly: Right Industry, Wrong Price

Summary:

- Eli Lilly currently has a forward P/E of over 45x.

- This high valuation is much higher than the sector average.

- A pair trade between XPH and LLY is proposed.

jetcityimage

Introduction

I give Eli Lilly (NYSE:LLY) a sell rating. While I am bullish on the pharmaceutical space due to the rocky times in the future, I cannot be bullish on Eli Lilly due to its valuation.

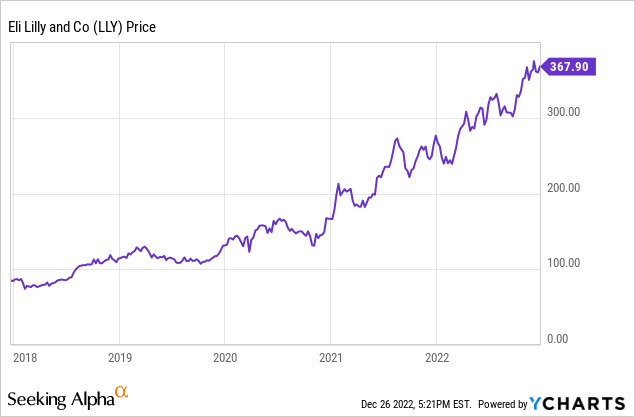

Eli Lilly five-year stock chart:

As of this writing, shares traded for $367.90, with an average of 1 million shares traded daily; Eli Lilly has a forward EPS of $7.79, creating a forward P/E of 47.20x and a 1.23% dividend of $4.52. Per the company’s last SEC filing, the company had $6.9 billion in revenue, leading to $1.45 billion in net income. Finally, the company had just over $2.7 billion in cash, cash equivalents, and short-term investments.

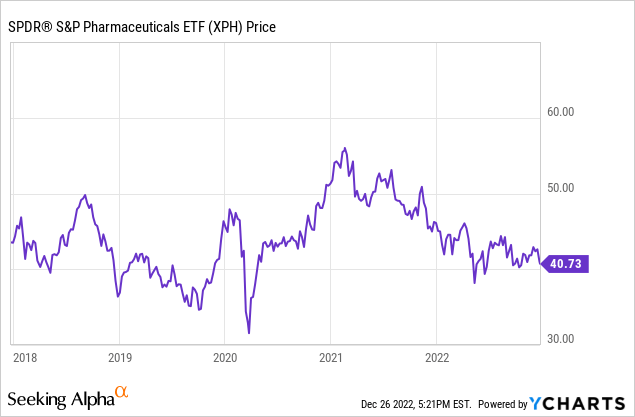

I give SPDR S&P Pharmaceuticals ETF (NYSEARCA:XPH) a hold rating. I think the industry is very favorably priced within the ETF and has the economic uncertainty priced in. While this would usually make a stock not worth buying, it is perfect for our case because it will represent a good measuring tape for Eli Lilly.

XPH’s top holdings are:

Top Holdings

| Name | Symbol | % Assets |

|---|---|---|

| Axsome Therapeutics, Inc. | (AXSM) | 8.56% |

| Cassava Sciences, Inc. | (SAVA) | 5.11% |

| Elanco Animal Health Inc. | (ELAN) | 4.74% |

| Johnson & Johnson | (JNJ) | 4.60% |

| Catalent, Inc. | (CTLT) | 4.57% |

| Bristol-Myers Squibb Company | (BMY) | 4.57% |

| Pfizer Inc. | (PFE) | 4.49% |

| Perrigo Company PLC | (PRGO) | 4.23% |

| Corcept Therapeutics Inc. | (CORT) | 3.94% |

| Nektar Therapeutics | (NKTR) | 3.88% |

XPH’s five-year stock chart:

Pharma Industry

Typically, companies in the pharmaceutical industry, such as those in XPH, are great for uncertain economic times. The healthcare sector and, more specifically, the pharmaceutical industry is uniquely well suited for performance during a recession. While the pharmaceutical industry won’t grow much, it will also not fall much. Pharmaceutical companies experience consistent demand for their products. People usually cannot reduce pharmaceutical-related expenses as much as they can with other companies in cyclical business, such as Netflix (NFLX). For this reason, pharmaceutical companies’ underlying businesses are not affected by economic conditions as much, which is why they outperform the general market during recessions which it appears we are heading into.

An interesting trade over the long term would be to make a pair trade between LLY and XPH. I would go long XPH and short LLY. This would be a bet on LLY’s valuation returning closer to the pharmaceutical average P/E of around 15-20x. Therefore, any change in our trade is not based on the economy or even the pharmaceutical industry. Instead, it is based solely on Eli Lilly to the rest of the pharmaceutical industry. While we are using XPH, any number of ETFs or other companies could be used in this trade. The key is to isolate broad market variables from the shorting play of Eli Lilly.

Why Make Pair Trade

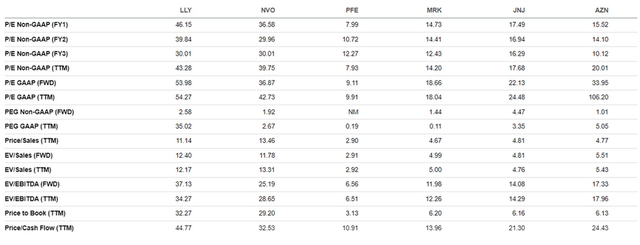

As discussed and shown in the article on Eli Lilly by Acutel, Eli Lilly has a very high valuation compared to its peers, as evident in the graphic created by Acutel below.

Acutel

Eli Lilly is considered overvalued in any metric you look at, but the short interest for the stock remains low. For some reason, investors are willing to pay a premium for Eli Lilly.

Consulting firm Acutel believes a few reasons could be contributing to this. It’s important to know these reasons because if Eli Lilly can successfully grow like some investors think it will, it will hurt any short position. Some of Acutel’s reasons are:

These hopes have largely been fueled by LLY’s robust product pipeline. The company intends to launch five new medicines by the end of 2023. Of the five candidates, two have strong sales potential and have caught the attention of investors. These are Mounjaro (tirzepatide), which has been promoted as a weight loss treatment, and donanemab, for early Alzheimer’s disease…

Another factor that investors could have priced in is the fact that LLY is highly committed to R&D, which is what drives value creation in healthcare. 25 cents of every dollar in sales is funneled to R&D while 2 in every 10 of its workers work in R&D, according to data on its website. The earnings potential that comes with this level of investment in R&D is high…

Finally, another possible reason why investors are looking past LLY’s high valuation is the signals the management is sending out about potential future cash generation. The company has been growing its dividend consistently since 2014, with the latest payout growth being 15%.

I agree with Acutel on these reasons contributing to the valuation, but overall, I still believe its valuation will start to trend back closer to other pharma companies.

In particular, one drug that is bringing a significant increase in Eli Lilly’s valuation is donanemab which, if successful, will be a massive boost. However, my investment research work is in the AD space, and I have written extensively about it, including a full overview of the space, and I believe that donanemab will fail.

Discussing broadly amyloid theory drugs in the above-mentioned article I wrote:

Aduhelm had such a controversial approval and was later not covered by Medicare because of a set of issues that appears to be shared across Amyloid theory drugs. Amyloid therapies are known to cause “amyloid-related imaging abnormalities (ARIA), referring to swelling/edema (ARIA-E) or bleeding/hemorrhage (ARIA-H) in the brain.”

Moreover, these drugs appear to have a limited patient population for which they are genuinely effective. APOE4 is considered the most decisive risk factor for AD, 25% of people carry one gene, and 2% have two genes. This gene causes an increased build-up of amyloid, which is likely why this subpopulation sees the best results; however, they also experience the most substantial side effects from this drug class, such as the ARIA mentioned above.

All of these issues pertain to donanemab, and I believe it will be the downfall of the drug. An AD drug could earn over $20 Billion a year. Considering that Eli Lilly’s top-performing drug for 2021 was Trulicity bringing in $6.5 Billion, the impact, or what I will believe will be a lack of impact, of donanemab cannot be understated for the valuation of Eli Lilly.

I think XPH is fairly valued and pricing in the economy, making it a great measuring tool. Hedge Insider wrote in agreement about this in a recent article. Other proxies could be used in this trade, whether another big pharma company like Pfizer or another ETF.

Risks & Conclusions

Being short creates unlimited downside. For this reason, if Eli Lilly were to come out with something that drastically changed their valuation, then there would be a loss taken on this trade. Shorting a stock is high risk and not a play for everyone.

Overall, the valuation of Eli Lilly is far higher than the sector average. A bet that these will start to balance looks to be favorable. However, taking this bet opens an investor up to the downside of being short a stock. Considering the high valuation compared to the industry average, I still think a favorable opportunity exists.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.