Summary:

- Despite the soft advertising market outlook, the cost-efficiency plan will weigh in the company’s earnings in the next few quarters.

- The Reels/WhatsApp monetization and the 2024 US Presidential elections will strongly support ARPU in the following 1-2 years.

- Zuckerberg knows the only way to regain leadership is to attract more teenagers and young adults, and Reality Lab products such as Horizon Worlds are the bridge to Meta’s supremacy.

- META’s investment thesis remains intact, and the strong bullish rating is supported by the improving outlook leading to a target price of $215-$257.

Kinwun/iStock via Getty Images

Investment Thesis

In light of a potential economic crisis, advertising seems to be growing more cautious. However, despite currency challenges, macro uncertainty, and a slowdown in overall digital advertising growth, Meta Platforms (NASDAQ:META) posted better-than-expected Q4 results.

Despite Meta’s challenges since 2018, such as Apple’s (AAPL) attempts to protect user privacy with App Tracking Transparency, a decline in ad revenue, considerable investments in the Metaverse, and regulatory scrutiny, the headwinds have already been reflected in the stock price. META has already bottomed out around $88-$89.

Not surprisingly, META has rebounded massively in the past month, significantly contributing to our model portfolio’s gains and delivering a 114% RoI in two months. Despite the strong bull run, I stay bullish on META on my personal and model portfolios, as the investment thesis remains intact.

Yiazou Model Portfolio

Cyclicality Kicks In With Cautious Optimism

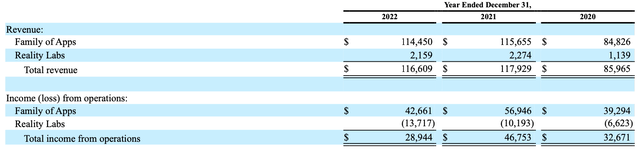

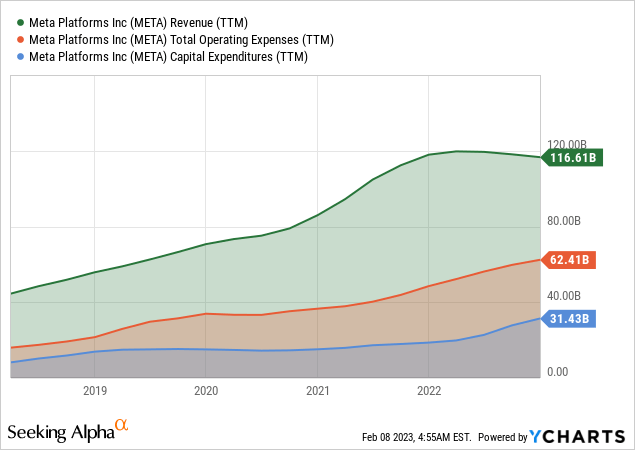

Meta’s revenue for 2022 dropped slightly to $116.6 billion, a 1.1% YoY decrease, but the number of active users on Meta maintained a rising trajectory. Favorably, user engagement increased YoY as daily user growth exceeded monthly user growth for Facebook and its family of apps ((FoA)). Meta’s outlook has slightly improved following management’s revenue guidance of $26-$28.5 billion in the first quarter, the new $40 billion stock repurchase plan, and the revised spending plan down to $89-$95 billion. The cost-efficiency news relieved investors and caused a spike of more than 20% in the stock price.

Meta’s 10-K 2022

Undoubtedly, advertising spending will slow in 2023 due to rising interest rates, inflation, and the sluggish global economy. As we all know, the ad business experiences ups and downs in a repeated pattern, known as cyclicality. For example, when the economy is strong, businesses have more resources to allocate toward advertising and demand for ad space increases. Conversely, ad spending decreases during economic downturns as companies tighten their budgets. This creates a cyclical pattern of increased and decreased demand for advertising services.

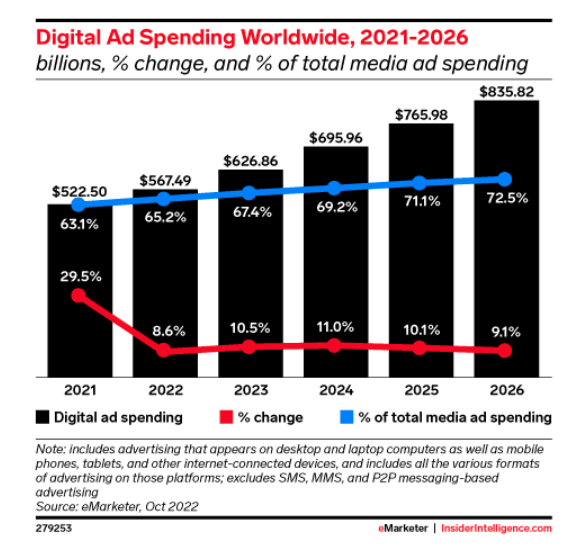

According to Magna, worldwide advertising revenue will increase by roughly 5% to $833 billion in 2023 from 7% in 2022, GroupM and Dentsu anticipate slightly faster growth in 2023. On the contrary, according to Insider Intelligence, they expect a 10.5% digital ad growth in 2023. Most businesses claim that rising inflationary pressures are driving down levels of marketing investment. At the same time, marketers at smaller companies report a rise in marketing spending, and marketing leaders in large companies report a decrease in marketing spending due to inflation. Nevertheless, using the midpoint of Meta’s revenue guidance for Q1, the $27.25 billion suggest a drop of 1.68% QoQ, setting a relatively easy target to beat.

www.insiderintelligence.com

Contextual Targeting Is Becoming A Thing

Delivering relevant advertisements to consumers based on the context of the content they are now seeing or engaging with is a technique known as contextual targeting in advertising. By aligning the context of the content with the goods or services sold, advertisers may make sure that the ads they display are pertinent to the interests of the customers they want to attract.

For instance, a reader of a food article would see advertisements for cooking tools or ingredients, whereas a reader of a sports article might see advertisements for sporting goods. Contextual targeting aims to improve the ads’ relevance and attractiveness to the target market, increasing the likelihood that the campaign will succeed.

The demand for first-party data is one of the ad tech trends that will persist in 2023. Marketers have been anticipating the same for Chrome users for a few years now as Firefox and Safari have begun to restrict third-party cookies on their respective browsers. Because of this, several companies have already begun to collect and use their first-party data (1P). 1P data is of higher quality and aids in understanding the customer’s needs. Meta has now developed more AI/ML tools to support contextual targeting, which are expected to significantly improve its ads’ relevance.

Meta’s top line will continue seeing headwinds due to privacy changes IDFA/ATT. However, management has mitigated the impact through various advertising options, such as ad formats that encourage conversions on-site and longer-term AI investments in privacy-enhancing technology. As a result of those efforts, advertisers saw over 20% more conversions than the previous year in the most recent quarter, which has led to increased returns on ad spending and lower acquisition costs.

FoA & The Metaverse

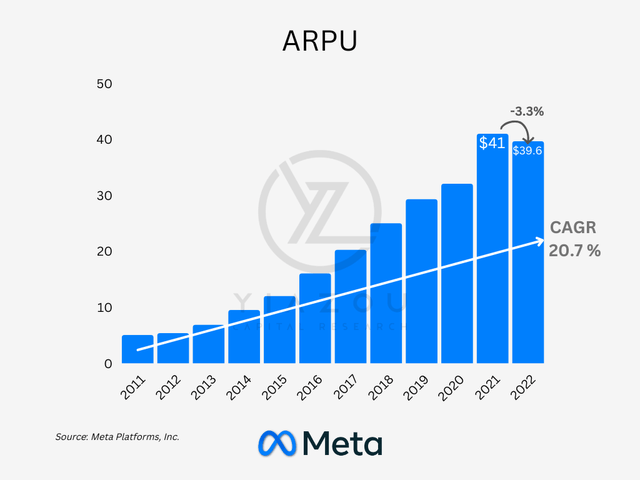

While the FoA has a sizable user base, in 2022, there were more than 2.93 billion monthly active users (MAU) globally. However, most of the monetization was driven by the US and Canadian users, which reported an average revenue per user (ARPU) of $58.77 in Q4, a nearly 20% QoQ increase. Undoubtedly, nations like the US and Canada have much bigger advertising budgets than other nations in Asia or Eastern Europe, especially given their higher GDP per capita.

Because they anticipate a strong RoI from these targeted efforts, advertisers are willing to pay more for advertisements, as evidenced by Meta’s ARPU. In addition, incorporating artificial intelligence, virtual reality, and augmented reality technology into various goods may further boost Meta user engagement and future ad revenue development. As a result, despite the minor drop of 3.3% in ARPU YoY, Meta has achieved an impressive 11-Year CAGR of 20.7% since 2011, and the positive trend should persist.

Yiazou Capital Research

Meta has strategically opted out from putting Reels advertisements since they want to promote its growth. As a result, Reels’ growth has exploded recently, and as it gains more traction, Meta is getting closer to monetization, which will substantially boost the overall ARPU in the foreseeable future.

Since 2008, a cyclical pattern in Facebook’s revenue seems to coincide with the US Presidential elections, as the previous three cycles appear to be correlated. The income growth for Facebook seems to peak in the year following the elections before leveling down for the remainder of the president’s term. In addition, the Democratic Governors Association used Facebook for almost 75% of its advertising budget in the 2020 election season, capitalizing on the app’s popularity and high targeting offerings. As a result, I expect the elections to meaningfully boost Meta’s revenues in the next 2-3 years.

Meta Can Regain Its Competitive Position

TikTok has grown to be the largest threat to Meta’s supremacy despite having a very low ad revenue. The fact that TikTok is the fastest-growing entertainment app in terms of popularity and downloads provides a clear understanding of its expanding popularity and danger to Meta.

More than 140 billion Reels are played daily on Facebook and Instagram, and Reels plays and resharings on Facebook and Instagram “have more than doubled over the last year,” Increased engagement led to a 23% increase in impression sales over the previous year, partially offset by a 22% drop in average ad prices due to rising supply and weak demand. Due to lower ad pricing, user monetization was down 8% from the previous year.

Additionally, one of the most important KPIs is the average time spent (ATS), and TikTok has shown that it may divert attention from other social networks. TikTok has done an excellent job of getting users addicted to short videos for amusement, and in 2022, users spent nearly 46 minutes on the app daily. Comparatively, Meta’s FoA reported ATS for Facebook and Instagram of around 30 minutes each for the same period.

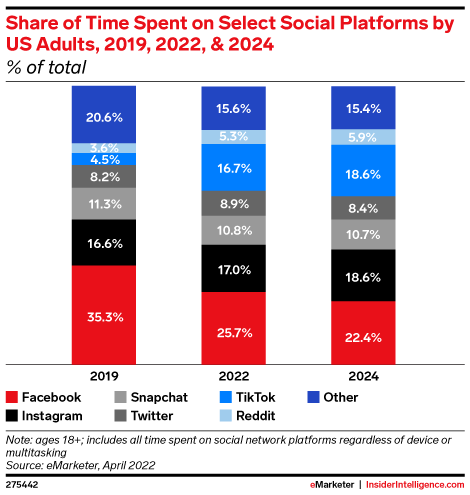

Moving into 2024, TikTok will continue its momentum but at a slower rate, and it is expected to capture 18.6% of the overall time spent on social media. On the contrary, Facebook’s ATS will shrink to 22.4% in 2024 from 35.3% in 2019, but Instagram is expected to rebound, competing head-to-head with TikTok at 18.6%. According to eMarketer, Meta will protect its competitive position in the foreseeable future, as in 2024, its FoA (Facebook and Instagram) is expected to account for 41% of the ATS.

www.insiderintelligence.com

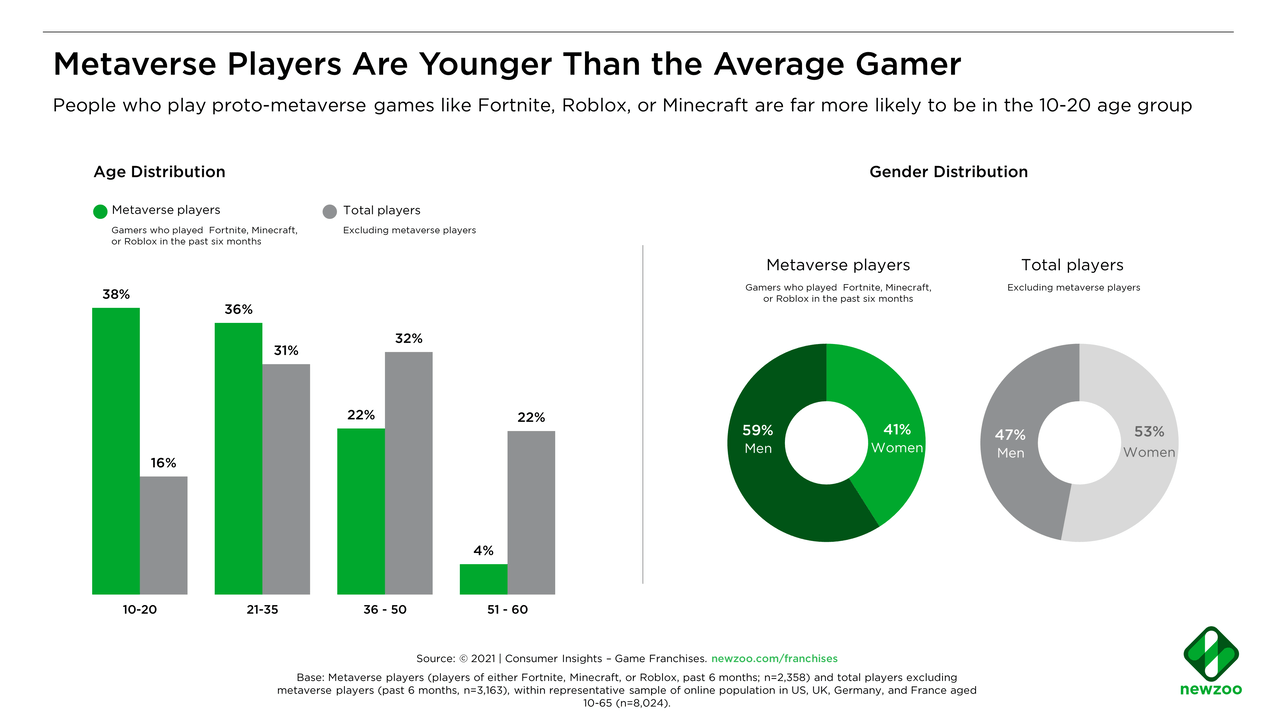

Millennials were drawn by Facebook and Instagram when they were teenagers, but TikTok has won the Gen Z era. As a result, Meta is now fighting back to win young users, but how? Younger generations of Gen Z and Alpha are undoubtedly growing up in proto-metaverses. For instance, in 2020, 54.86% of daily active Roblox users were under 13. So it’s not surprising to see consumer brands and major tech companies doubling down on Metaverse because these high-value, youthful consumers are difficult to reach through conventional marketing strategies and social media. As an alternative to Twitch, Meta Platforms has been paying videogamers since 2018 to stream their gameplay on Facebook. However, in this new time of austerity, Meta is reducing those payouts.

www.newzoo.com

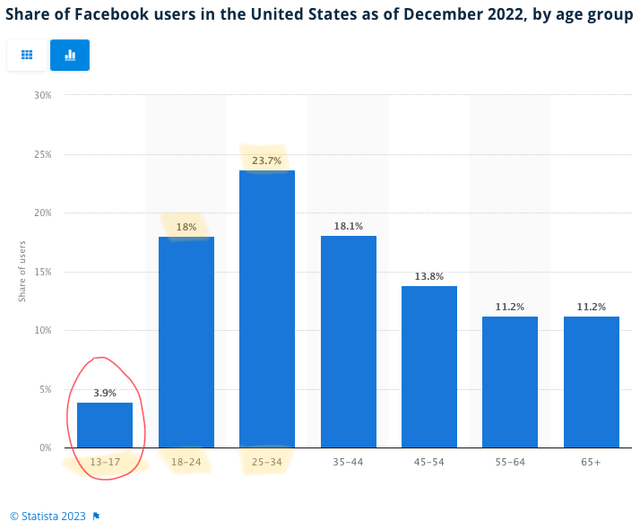

As we already know, Gen Z and younger generations are more likely to use newer social media sites like TikTok and not Facebook or Instagram. Specifically, Facebook’s user base is aging in the West, even if it is still quite popular in developing nations like India and Africa, with Millenials and Gen Z Facebook users in the US capturing nearly 42% of total users. So, not surprisingly, younger generations are not on Facebook, the same also applies to Instagram, but Meta has recognized this early, and its move towards Metaverse years ago proves Zuckerberg’s visions and deep understanding of user behavior and trends.

www.statista.com

Zuckerberg knows that Meta can only regain ground by targeting the new generation of the 13-17 age group. Not surprisingly, according to a new report from WSJ, Meta is redesigning its infant Horizon Worlds metaverse app to attract more teenagers and young adults. Additionally, Meta’s Joel Osbourne has recently stated that:

Teens are already spending time in a variety of VR experiences on Quest, and we want to ensure that we can provide them with a great experience in Horizon Worlds as well, with age-appropriate tools and protections in place,

To increase user growth and retention, Meta works with outside studios to create new worlds and experiences for Horizon. This is a crucial component of its strategy, and one of the key goals for the first half of 2023 is to increase user retention, especially among teens and young adults.

For 2022, the company’s reality labs division, which comprises consumer hardware, software, and content for augmented and virtual reality, recorded an operating loss of $9.4 billion. Nevertheless, Meta appears determined to prioritize the reality labs segment despite this appalling performance. Targeting the younger generation remains vital for Meta’s future, and Horizon Worlds’ progress will strongly support the company’s ambitious plans.

Cost Efficiency Plan Relieves Investors

With its revised cost-cutting strategy for 2023, which was reduced from $94–$100 billion to $89–$95 billion, the company’s forecast also demonstrated a renewed focus on cost control and cost-cutting. In addition, due to switching to a more cost-effective strategy, management also reduced its CapEx forecast for the year, stating it would only spend $30 to $33 billion, down $4 billion from its previous estimate.

Zuckerburg will try to flatten Meta’s organizational structure, eliminate middle management, and use AI tools to assist engineers in working more efficiently. Moreover, the $4.2 billion in restructuring costs for severance and related expenses, as well as the closing of several of its offices and data centers, were incurred during the quarter. The severance costs reflect the company’s earlier choice to eliminate 11,000 employees.

Valuation Remains Attractive

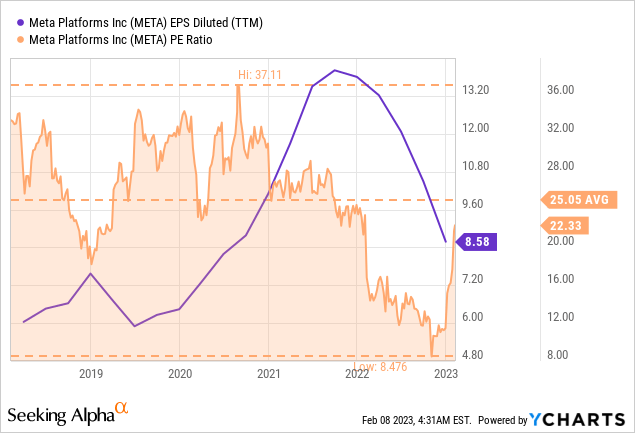

In the following 2-3 years, we expect a rerating in META’s P/E multiple, derived from a combination of higher EPS due to growth and reduced expenses. Assuming a moderate annual growth of 2-3% in 2023, with a strong rebound in 2024-2025 of 15%+ annual growth (in light of US presidential elections, Reels/WhatsApp monetization, and cyclicality effect), META can regain valuation ground and trade at a P/E of 25-30x, implying a target price of $215-$257.

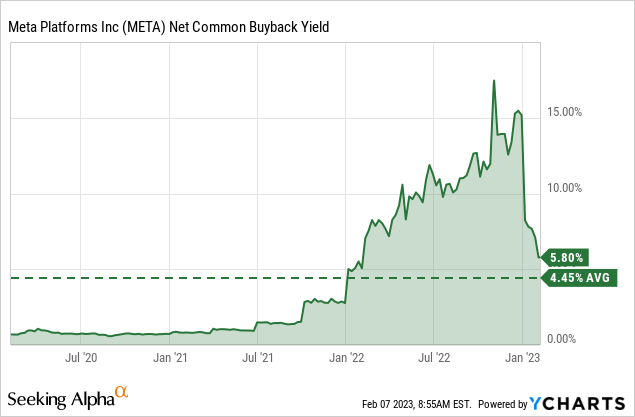

Meta spent $6.9 billion on repurchasing its Class A common shares in Q4 bringing the total amount of shares it has purchased this year to $27.9 billion. They had a remaining authorization for repurchases of $10.9 billion as of December 31, 2022. Over the past three years, the average buyback yield was around 4.5%, but the recently announced plan of an additional $40 billion in buybacks expanded to nearly $51 billion or around 10% of the current market cap.

Concluding Thoughts

Meta strives for control over its business model in the long run, and the only way to achieve that is by reinventing its data supply chain from the ground up. Unfortunately, Meta mainly relies on the mobile distribution pipelines of Apple and Alphabet Inc. (GOOG) (GOOGL), and the recent privacy changes are impacting the company’s business model, exposing its vulnerabilities. Indeed, Meta doesn’t operate a mobile marketplace like Apple and Google, and Zuckerberg’s attempt to create his data supply chain in the future (from hardware to software, operating system, and marketplace on top of which users experience the brand) is the only way to regain supremacy and make Meta an absolute near monopoly powerhouse.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.