Summary:

- Micron had a weak Q1. Q2 will be even worse, with significant net losses and weak margins.

- MU is well-positioned for a downturn, however, thanks to massive cash reserves.

- Micron is pretty cheap and could be a reasonable investment at current prices for someone with a longer-term view.

MicroStockHub

Article Thesis

Micron Technology (NASDAQ:MU) reported weak quarterly results. Guidance suggests that the current quarter will be even worse, thus Micron has not hit the bottom, yet, from an operational perspective — the worst is yet to come.

At the same time, the long-term outlook is positive and the valuation based on future profits seems pretty low, thus shares could be attractive around current levels for someone with a longer-term view that plans to ride Micron the higher levels as the memory market should rebound eventually.

What Happened?

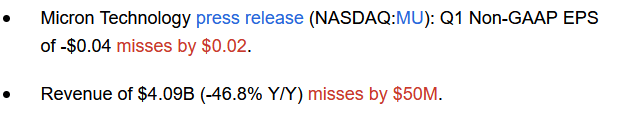

Micron reported quarterly results that were far from great:

Seeking Alpha

Despite the fact that analysts were already expecting a net loss and a steep revenue decline, Micron underperformed those expectations. The net loss was larger than expected, and revenues declined even more compared to what Wall Street analysts had forecast.

The Worst Is Yet To Come

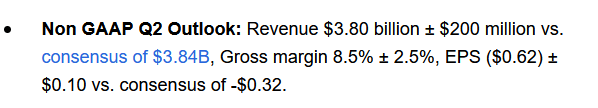

Even worse, however, was Micron’s guidance for the current quarter, its fiscal Q2. Seeking Alpha summarizes Micron Technology’s guidance for the current quarter in the following way:

Seeking Alpha

With a revenue midpoint of $3.8 billion, revenue will thus decline by around 7% compared to the most recent quarter, representing a considerable sequential decline. On a year-over-year basis, revenues will be down massively, as they were during the first quarter of the current fiscal year (the one reported this week).

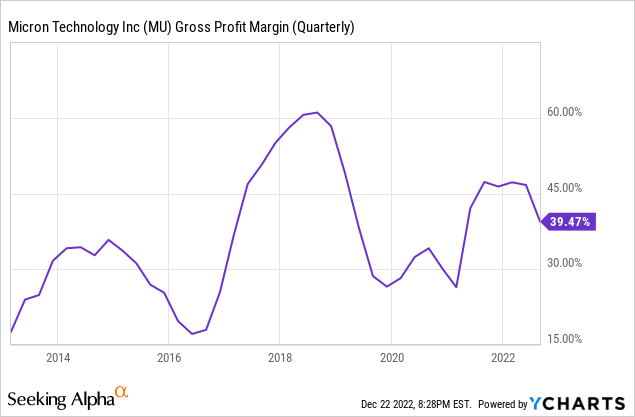

Gross profits are expected to drop as well, with the gross profit margin forecasted in the high single digits. For a tech company, that is pretty bad, and it also compares very unfavorably to Micron’s gross profit margin in the past, as we can see in the following chart:

Over the last decade, Micron’s gross profit margin hasn’t been in the single digits. This suggests that the current market downturn is a pretty serious one, relative to past market downturns, such as in 2020, when earnings declined as well. In 2020, however, Micron Technologies still generated meaningfully positive net profits — the worst quarter, FQ2, still saw a net profit of $0.45 per share or $1.80 annualized. For the whole year, Micron earned $2.83, which isn’t too bad. Since Micron is forecasting a net loss per share in the $0.60 range for the current quarter, investors can expect that the current fiscal year will be worse than FY 2020, as it is unlikely that Micron will be able to earn $3.40 or more during the latter two quarters of the current year. Improvements are expected towards the end of the year, but even for Q4, analysts are currently predicting a net loss. In short, the first quarter of the current year was worse than expected, but the remainder of the year will be even weaker. From an operational basis, the worst is yet to come, and Micron hasn’t passed the nadir yet. Of course, the market is always forward-looking, thus the share price could (and I believe it will) recover before earnings rise to attractive levels again. According to the current Wall Street consensus, meaningful profits are expected in early 2024, or a little more than a year from now.

What are the driving factors for the current market downturn and the weaker expected results in the next couple of quarters? Several factors are at play. First, global chip markets have experienced improving supply and worsening demand, which causes some analysts and investors to talk about a “glut”. Naturally, higher inventory levels and lower demand incentivize manufacturers to lower their prices in order to sell the volumes they want to sell, which hurts overall revenue generation and margins. Micron’s CEO, Sanjay Mehrotra, stated the following during the earnings call: “The industry is experiencing the most severe imbalance between supply and demand in both DRAM and NAND in the last 13 years.”

That imbalance will not cease to exist immediately but should be balanced out over time. Contributing factors for that will be the long-term trend of growing memory demand due to macro trends such as digitalization, big data, AR/VR, and so on. At the same time, a weak pricing environment will make memory makers more reluctant when it comes to capacity investments, thus supply growth should be subdued going forward. In short, the cure for low prices is low prices, as is the case in many other cyclical industries as well.

Some Good News Despite The Weak Results

Despite a severe near-term downturn in both of Micron’s end markets, DRAM and NAND, there still are some positives investors should consider. First, Micron is already reacting to the current price environment by cutting capital expenditures and wafer starts, according to management’s comments in the earnings call (linked above). This will serve several purposes. It will allow Micron to preserve cash during this downturn, which is always good news as it reduces risks and since it gives Micron flexibility to put cash to use where it sees the most value, e.g. by doing buybacks or by paying down debt. On top of that, restraint when it comes to investments will reduce near-term supply growth, which should allow for a more balanced market in the not-too-distant future. This will not happen overnight, but investors won’t have to wait for several years until market conditions improve when the players in this oligopoly, including Micron, react rationally by reducing their investments.

Micron also goes into this downturn with a very strong balance sheet. During past downturns, such as 2016/2017, Micron had considerable net debt still. Right now, on the other hand, Micron has a net cash position of $1.8 billion. Even better, its available liquidity is massive, as total cash amounts to more than $12 billion as of the end of the first quarter. Even if Micron burns considerable amounts of cash in the next couple of months, it is, I believe, highly unlikely that the company will run into liquidity problems.

Cash flow during the most recent quarter also was positive, despite the fact that Micron reported a net loss for the period. During the quarter, operating cash flow totaled more than $900 million, which was more than the cash flow the company generated during some past downturns. Cash flow during the current quarter could be weaker, as revenues and profits are forecasted to be worse, but I believe that it is highly likely that cash flow will remain easily positive. A $300 million revenue headwind could, if it flows through the earnings statement, reduce operating cash flow to $600 million or so. But Micron is working on offsetting those headwinds, e.g. by reducing operating expenses. Current forecasts by management suggest that operating expenses will fall by more than $50 million sequentially.

I do believe that another positive factor is management’s willingness to buy back shares during the first quarter. Management knew that Q1 results wouldn’t be great, as the actual results were relatively in line with what management had guided for previously. And yet, management thought that buying back shares made sense — they seem to see value at Micron’s current valuation, despite near-term headwinds. One can argue that it would have been better to preserve even more cash, but when insiders that know the company and the market best decide that shares are undervalued despite this downturn, that sends a positive sign of confidence when it comes to the company’s long-term potential.

Valuation

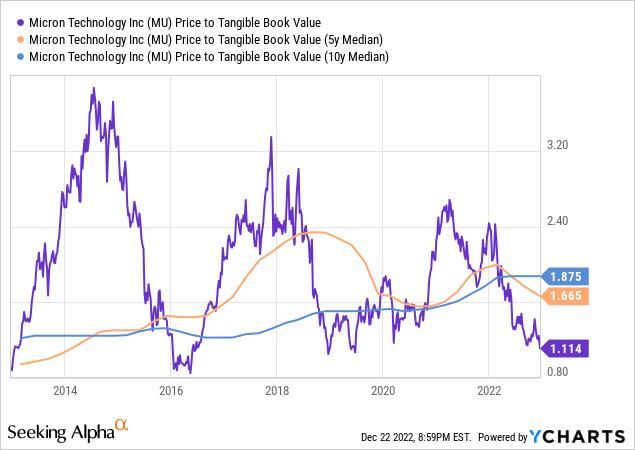

Since Micron isn’t profitable in the current quarter, and likely the current year, we can’t really value Micron based on earnings, at least not by using near-term profits. We can, however, look at book value, which doesn’t move as quickly.

Right now, Micron trades at 1.1x tangible book value, which backs out intangibles such as goodwill. That’s way lower than the long-term median multiples of 1.7-1.9, depending on the time frame we look at. Since net losses are expected in the next couple of quarters, book value will drop slightly. When we take current analyst estimates at face value, Micron’s tangible book value will drop to a little more than $42 over the next four quarters, accounting for expected dividend payments over that time frame. Relative to the current share price, that makes for a tangible book value multiple of 1.2. From that point onwards, earnings per share will be meaningfully positive again, according to the analyst community, thus book value should start to climb again. Even at the expected bottom of this cycle, Micron will thus still be trading at a historically inexpensive valuation from a book value perspective. If Micron were to hit a $42 book value a year from now, and if that rises to $45 over the following year (which would be in line with current EPS estimates for 2024), then Micron could be trading at $68 two years from now at a hypothetical 1.5x tangible book value multiple. That would allow for a share price return of more than 35%, and Micron would still be trading at a below-average valuation in this scenario, as the median tangible book value multiple is north of 1.5.

Takeaway

Q1 wasn’t good, and the next couple of quarters will be even worse. Micron hasn’t hit the bottom yet from an operational point of view — the worst is yet to come. But Micron is well-positioned for the long run thanks to a strong balance sheet with massive liquidity. Memory demand growth drivers such as AI and digitalization remain in place, and constraint when it comes to investments should help balance the supply-demand situation in the not-too-distant future.

Micron is trading at a very undemanding valuation right now, thus even though the near term won’t be rosy from an underlying results perspective, shares could be a reasonable long-term investment at current prices. It can be expected that Micron’s share price starts to recover before profits do — that has been the case in the past as well.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!