Salesforce Is Improving Profitability, But Remains Expensive

Summary:

- Benioff’s valuable leadership experience gained over the last two decades enables him to prudently steer Salesforce through the potential economic downturn ahead and bounce back stronger.

- Management is prudently focused on delivering growth while continuing to expand operating margins, but the stock remains expensively valued relative to peers.

- Intensifying restrictions on data processing, storage and transfer practices could indeed undermine the efficacy of Salesforce’s sales solutions and AI services.

- Co-CEO’s departure raises the risk of Salesforce running into a similar plight to Disney’s succession mayhem, whereby the company struggles to find a competent successor to the high-achieving predecessor.

Takako Hatayama-Phillips

Following weak revenue guidance and the departure of co-CEO Bret Taylor, Salesforce (NYSE:CRM) stock has taken a beating. This comes amid a weakening macro backdrop and increasing fears of a recession ahead, which is pressuring enterprise spending and leading to subdued revenue growth for companies like Salesforce. Despite the concerns, Salesforce remains a strong player within the Customer Relationship Management [CRM] industry, and is well-positioned to navigate the economic headwinds ahead, though the stock remains expensive.

Benioff remains a valuable asset to Salesforce

The worsening macroeconomic outlook has inevitably led to tightening corporate expenditure on enterprise software solutions, resulting in elongated sales cycles and increased scrutiny on resource allocation decisions on enterprise solutions. Enterprise spending pullbacks tend to be more pronounced in sales & marketing solutions.

As President & COO Brian Millham stated on the Q3 earnings call:

Some of the products that get cut early in a downturn, marketing spend would be one that we see impacted fairly early on … CEOs make quick action, and that’s a quick action, and that’s a quick place to sort of pull back on marketing. We did see less expansion on sales and service in the quarter on incremental users as our customers started to maybe do a little less hiring. Maybe they paused hiring we saw less expansion on the Sales Cloud users and Service Cloud users.

Subdued revenue growth and softer billings amid weakening economic conditions will likely hamper near-term growth prospects. That being said, Salesforce is well-positioned and experienced in navigating economic downturns to ensure Salesforce bounces back even stronger.

CEO Marc Benioff has been at the helm of the company since 1999, hence has experiencing steering the ship through various economic downturns, including the 2001-02 recession following the dotcom bust, and the Great Financial Crisis & Recession 2007-09. Benioff has prudently developed a playbook based on these collective experiences, to enable Salesforce to navigate through downturns successfully. As Benioff proclaimed on the Q3 earnings call:

We’ve actually developed our own playbook. We really wrote it all down. We talked about what was happening we knew would happen again. And we had to dust off some of those plans and numbers from 12, 13 years ago from 22 years ago. And we’ve turned that playbook in gaining market share and focusing on operational discipline and operational excellence, especially in the face of economic headwinds. And as the economy has started to recover, whether it’s in 2010, or even in 2002, we were able to radically accelerate our growth…

We’re following our playbook to make sure we’re well positioned to gain market share, to increase our profitability, to focus on our operating margin, to focus on the growth of our revenue and be able to continue to invest, especially when the economy recovers

Benioff’s valuable leadership experience gained over the last two decades is an asset for Salesforce, as this is a CEO that knows where to cut back and where to continue investing to enable the company to bounce back stronger and outpace its rivals in penetrating the growing enterprise software market.

Not all SaaS CEOs are necessarily as seasoned as Benioff. For instance, Shopify CEO Tobias Lutke, leading a rising e-commerce giant that is also expanding into more enterprise software solutions, sounded less convincing earlier this year:

In a conversation with Bessemer, one of Shopify’s venture backers, Lutke likened market disruptions like the 2008 recession and the current pandemic to “shaking a tree and seeing what falls off.”

While each downturn has its own surprises, Marc Benioff exhibits remarkable preparedness and wisdom in not only maneuvering through the impending recession, but also continuing to grow throughout the hardships.

Stock remains expensive amid expanding operating margins

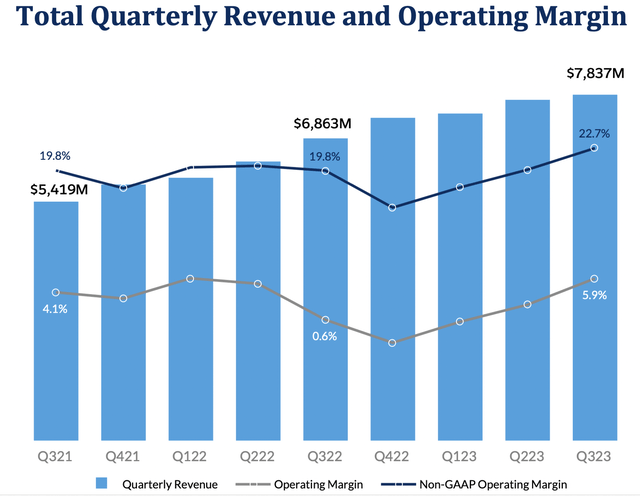

Investors have been concerned about the impact of the Slack acquisition on Salesforce’s profit margins, and these concerns have amplified amid top-line growth moderation. Despite the revenue growth slowdown, Salesforce has been expanding its operating margin over the last several quarters, delivering year-over-year operating margin (GAAP) growth of 5.3%.

On the latest earnings call, management reiterated its resolute focus on delivering profitable growth, and more specifically to continue expanding operating margins over the coming years. As Benioff stated on the Q3 earnings call:

We want to continue to grow revenue, we want to continue to grow our operating margin and we want to look at strategic opportunities. But we’re not going to do that at the expense of our operating margin. We’re going to continue to grow it…I think that you also watched us very closely through 2008 and 2009. And you can see how we acted then to increase operating margin

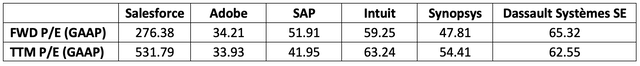

Profitable growth is certainly a compelling story under the current market conditions, but investors aren’t convinced. The stock has continued to get battered despite expanding operating margins. While management’s prudent focus on profitability is certainly preferable amid the subdued risk appetite for loss-making growth stocks, the stock still remains vastly overvalued relative to enterprise software peers.

Both on a forward and TTM basis, Salesforce’s P/E multiple far exceeds those of competitors within the enterprise software space. While Salesforce has been expanding its operating margin, the Slack acquisition still undermines margin growth. With more planned acquisitions going forward, investors are bracing for more profit margin headwinds despite management optimism, undermining the stock’s ability to continue commanding a premium P/E multiple. Hence, the stock is likely to continue facing downward pressure given the expensive valuation in my view.

More Risks

While Salesforce certainly has strong long-term growth potential through continued penetration of the enterprise solutions market, investors must keep in mind that the effectiveness of its solutions, particularly its flagship Sales cloud service, relies on the processing of personal data. Data privacy is becoming an increasingly prevalent matter globally, including both government-led measures like EU’s proposed e-Privacy Regulations, as well as industry-led initiatives.

Salesforce cites these risks in its annual report:

These developments could reduce demand for our services, require us to take on more onerous obligations in our contracts, restrict our ability to store, transfer and process data or, in some cases, impact our ability or our customers’ ability to offer our services in certain locations, to deploy our solutions, to reach current and prospective customers, or to derive insights from customer data globally.

Intensifying restrictions on data processing, storage and transfer practices could indeed undermine the efficacy of Salesforce’s sales solutions and AI services like its latest Genie Customer Data Cloud, which could in turn reduce demand for its solutions, undermining pricing power and subduing revenue growth prospects. Amid evolving regulations, Salesforce will have to adjust or re-design its solutions to try and maintain the effectiveness of its leads-generation mechanisms and AI-based predictions. Though this will require constant R&D expenditure to maintain compliance with each country’s/region’s unique data privacy regulations (only adding to the complexity), undermining Salesforce’s ability to expand operating margins, conducive to further downward pressure on the P/E multiple that the stock is able to command.

The departure of co-CEO Bret Taylor has also raised succession concerns. Taylor was indeed a valuable member of Salesforce’s C-suite, and a potential, potent successor to Marc Benioff. His departure raises the risk of Salesforce running into a similar plight to Disney’s (DIS) succession mayhem, whereby the company struggles to find a competent successor to replace the high-achieving predecessor.

As discussed earlier, Benioff’s leadership experience at the helm of Salesforce for over two decades enables investors to be confident in the company’s ability to successfully navigate the worsening macro environment and continue to grow the company profitably. Whether Salesforce will be able to find a suitable successor will be determined over time, but investors must brace for a possible scenario where Benioff’s departure could pressure the stock price while the market tries to determine whether the successor can continue to competently capitalize on the long-term secular growth trends towards the digitalization of enterprise solutions.

Summary

I think Salesforce is well-positioned to weather the harsher economic conditions ahead while continuing to benefit from long-term secular growth trends in the enterprise software market. Management is prudently focused on delivering growth while continuing to expand operating margins. That being said, the stock remains expensively valued relative to peers, aggravated by subdued revenue growth amid weakening economic conditions, and rising succession concerns amid the departure of co-CEO Bret Taylor. The stock could indeed continue witnessing P/E multiple compression over the near term, therefore inducing a ‘hold’ rating.

Disclosure: I/we have a beneficial long position in the shares of SHOP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.