Summary:

- Tilray and Canopy Growth recently released earnings that highlighted the continued headwinds faced by legal Cannabis operators in Canada.

- Both companies realized declines in revenues from their year-ago figures, with Canadian black market cannabis sales now accounting for 40 cents of every $1 spent on cannabis.

- Positive returns this year will be driven by a recovery of long-beleaguered positive animal spirits, with the US being the longer-term prize.

IRA_EVVA/iStock via Getty Images

Tilray (NASDAQ:TLRY) and Canopy Growth (NASDAQ:CGC) both represent two sides of the great cannabis dream. Both went public in 2018, some months before the legalization of recreational cannabis sales in Canada. Now nearly five years later, both look to define bright futures against a North American medicinal and recreational cannabis market that has not lived up to initially buoyant expectations. Canopy Growth just released earnings for its fiscal 2023 third quarter, ending December 31, 2022, on the back of Tilray’s fiscal 2023 second quarter earnings, ending on the 30th of November 2022. Both earnings continue to paint a vivid picture of the headwinds and opportunities the current cannabis zeitgeist poses to its participants.

To be clear here, the Canadian cannabis market remains structurally opposed to long-term shareholder value creation due to its burdensome regulations and a black market that has remained sticky. Want to make money investing in cannabis? Pivot your operations to the US. However, this has been complicated due to cannabis still being illegal under US federal law. Hence, Tilray and Canopy Growth are still largely excluded from the expansive US cannabis market which is set to reach more than $34 billion by 2025, around 5x larger than the forecasted size of the Canadian cannabis market in the same year.

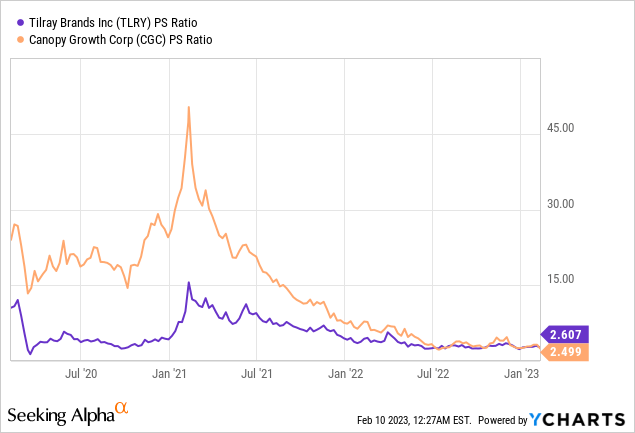

However, the biggest driver of returns for both stocks this year will be their respective valuations. This has ebbed and flowed between extreme euphoria and extreme fear, with the current downward momentum now a nearly two-year event. The recovery of market sentiment forms the foremost factor for the outperformance of either TLRY stock or CGC stock this year. This would see a broadly similar retrospective PS ratio move higher against their base to attach a larger market cap to both. Investing based on the reading of animal spirits is impossible and the focus should be on owning companies with high profitability, momentum, and balance sheet strength.

How Do Tilray And Canopy Growth’s Fundamentals Compare?

Canopy Growth reported earnings yesterday before the market opened. The $1.33 billion market cap Smiths Falls, Ontario-based company reported revenue of C$101.21 million, a marked 28% decline from its year-ago quarter and a miss of C$15.16 million on consensus estimates. There was more bad news with Canopy set to undergo another restructuring straight on the back of a previous move to quit cannabis retailing in Canada and shift its focus to its fledging US MSOs Acreage Holdings (OTCQX:ACRHF) and a number of other US-based cannabis entities. The new restructuring is being billed as another cost reduction measure with management stating during their earnings call that they aim to realize an additional $140 million to $160 million in reduced operating expenses over the next 12 months.

There are now two different cannabis markets in Canada; the highly regulated and heavily taxed legal recreational cannabis market that started on the 17th of October 2018 and the black market. The latter was described as “thriving” by Canopy Growth’s David Klein, its Chief Executive Officer. Hence, the initially large estimates for Canada’s total addressable market have failed to be realized with legal and illicit operators both battling it out for market share. Illicit sales represent around 40% of Canada’s overall cannabis sales, a structural headwind that meant Tilray’s revenue for its last reported quarter at $144 million declined by 7.1% from its year-ago figure. The $1.86 billion New York-based firm which reports in USD, is more diversified across non-cannabis segments with an extensive beverage alcohol business that brought in sales of $21.4 million during the quarter. This was a growth of 56% over its year-ago comp and came as wellness revenue reached $8.8 million, an increase of 88% over its year-ago figure.

Profitability for both firms diverged markedly. Tilray reported cash flows from operations of $29.2 million, up from a loss of $17.1 million in the year-ago quarter. With capex at $4.5 million, down from $7.5 million in the year-ago period, the company’s net free cash flow came in at $25.4 million. This was versus negative EPS of $0.06, a small miss by $0.01 on consensus estimates.

Canopy Growth’s free cash flow during its third quarter came in negative at C$146 million. Whilst this was a 13% decrease in outflows versus the year-ago period, the deeply negative figure moved to materially erode its liquidity position during the quarter. This negative cash flow came on the back of negative EPS of C$0.54, a significant miss by C$0.31 on consensus estimates.

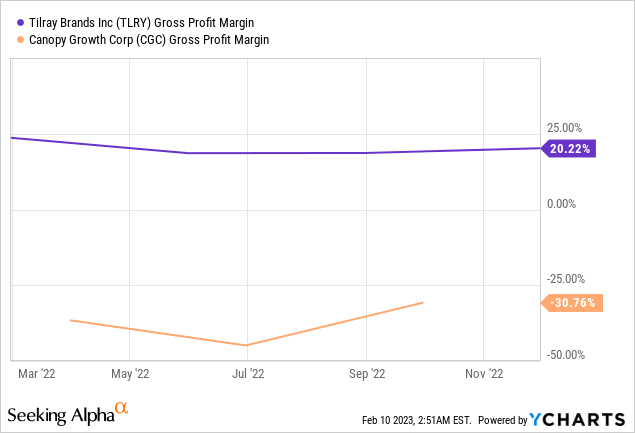

Canopy Growth would report negative gross margin of 2% during its last reported quarter versus a positive gross margin of 28% for Tilray. Critically, this divergence is exacerbated by Tilray’s broad shift away from cannabis sales. As Tilray continues to expand its wellness and beverage business, we could see this divergence continue to expand.

The Direction Of The Cannabis Market

Both companies are now well underway with efforts to streamline and reduce costly operational footprints and bring the core operations into sustained profitability. Tilray is further along this journey with the company reporting annualized cash cost-savings of $119.6 million since the closing of its merger with Aphria. Hence, with the company previously guiding for total cost savings of around $130 million, there is still around $10.4 million of savings left to be realized.

Canopy Growth’s cash and equivalents as of the end of the quarter was C$789 million, down from C$1.4 billion in the year-ago quarter. Canopy Growth is still in a state of operational flux, with the hope to move to a more asset-light model in Canada where it will source cannabis edibles, vapes, and extracts from third parties. Tilray reported cash and equivalents of $433.5 million, an increase from $331.8 million in the year-ago comp.

Is TLRY or CGC stock a better buy? Tilray is broadly trading at a similar valuation multiple to Canopy but comes with significantly higher profitability and an attractive non-cannabis portfolio which presents a unique investment case. I’m neutral on both, but Tilray looks like the better buy here. Where the cannabis market is heading forms the core part of the conversation around returns this year. With no clear momentum on the federal legalization of cannabis sales in the US, we could see both stocks continue to trade down.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.