DraftKings: A Strong Buy On Sticky Monetization Trends

Summary:

- DraftKings has grown from a fledgling gambling outfit into a betting juggernaut over the last few years, gaining share and reaching an inflection point in profitability.

- With an undemanding 5x sales multiple, there’s room for expansion and appreciation through multiple routes.

- We see a 25%+ annualized upside through 2026 as a strong possibility, as marketing spend continues to slow and the company keeps rapidly growing users & RPU.

- We rate the stock a “Strong Buy”.

Darren McCollester/Getty Images Entertainment

A few years ago, DraftKings Inc. (NASDAQ:DKNG) was, in our view, and to put it mildly, an expensive-looking train wreck.

After going public via SPAC in 2020, DKNG quickly became one of the cohorts of stocks that was clocking very high revenue growth, and thus trading in the ‘speculative basket’, which included names from other ‘high-growth’ sectors like cannabis (Canopy Growth Corporation (CGC), Tilray Brands, Inc. (TLRY)), 3D printing (Desktop Metal, Inc. (DM), Nano Dimension Ltd. (NNDM)), Self Driving / EVs (Luminar Technologies, Inc. (LAZR), QuantumScape Corporation (QS)), etc.

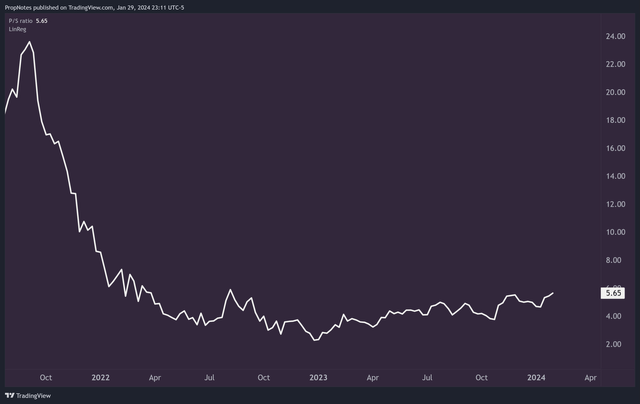

Sales multiples were in the 30s(!), and profits were nowhere to be seen.

However, unlike the rest of those stocks we just mentioned, DKNG has been able to successfully execute its business opportunity, and today the company holds the title of being the second largest online sportsbook and iGaming site in the U.S., only slightly trailing behind Flutter Entertainment plc’s (FLUT) FanDuel brand.

Not only that, but the stock appears to be much more well-positioned from a multiple standpoint. While traders were paying upwards of 30x revenue in early 2021, today the stock trades at a much humbler 5x revenue valuation. Combined with the fact that many DKNG markets are beginning to turn the corner on profitability, the investment case here is beginning to look quite compelling.

Today, we’re taking a look at DKNG’s transformation from speculative hype stock to betting juggernaut, and explaining why we think the stock is materially undervalued relative to its market opportunity.

Sound good? Let’s jump in.

Financial Results

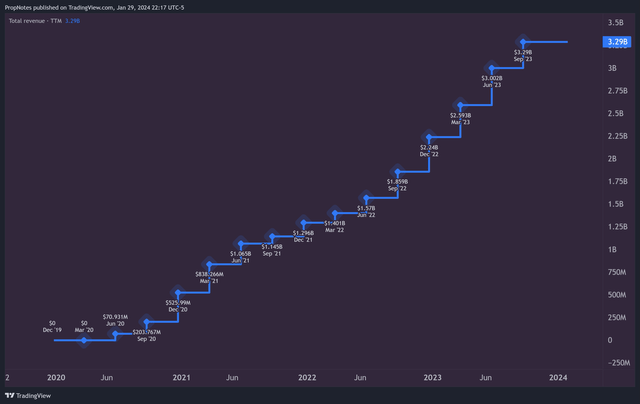

The last few years have been full of change for DKNG, but you wouldn’t know that by looking at the company’s revenue growth trajectory since the company went public in 2020:

Sales have grown like clockwork throughout this time, powered by a VERY high level of ad spend (and resulting customer acquisition cost (‘CAC’)), along with the legalization of online sports betting throughout 26 states in the U.S. over this same period. Growth was also impacted by the high level of stimulus that U.S. adults received in 2020 and 2021 as a result of Covid, although to some degree that revenue driver has since dried up.

Under the hood, however, things have been changing rapidly.

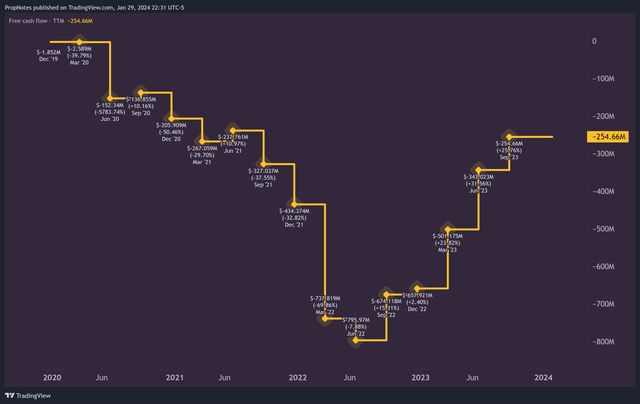

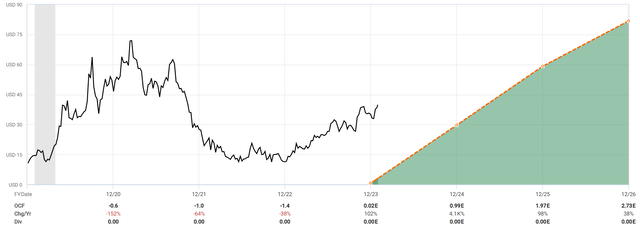

What once was a highly unprofitable company is now one that has begun to turn the corner on FCF and EBITDA profitability:

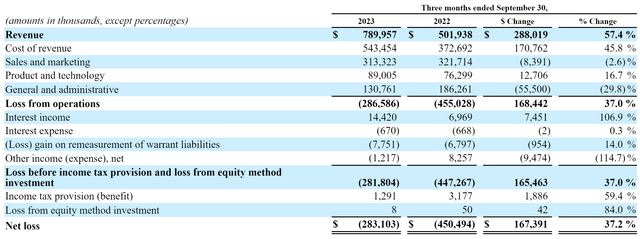

It’s true that the company isn’t there yet, but the trend of increasing FCF losses has abated and turned around. This is in part due to the company’s maturing market dynamic, which has resulted in lower ad spend YoY:

DKNG is focused on acquiring customers rapidly once they enter a market, but as the market matures, management is able to reduce this spend to the point where it becomes profitable to operate there. This is how revenue was up in the most recent quarter by 57%, but marketing spend actually fell 2.6%.

As an investor, this is exactly what you want to see when you’re watching a company transition from user growth to a better balance of profitability & growth over time.

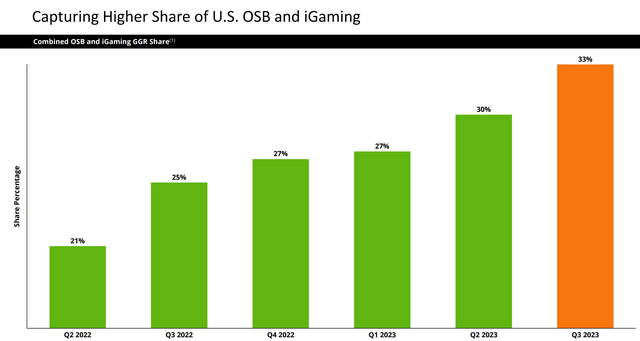

These results have also been coupled with DKNG actually gaining market share over the last 5 quarters as well:

These share gains haven’t come at the expense of FLUT’s FanDuel, which has remained in the top spot with ~45% share, but rather the smaller operators like MGM, Caesars, and Fanatics.

This has led to some extremely positive comments from management:

Our strong third quarter results and our visibility into continued improvement have enabled us to significantly raise our expectations for 2023 revenue and adjusted EBITDA. We are improving our full year 2023 revenue guidance range to $3.67 billion to $3.72 billion or by $195 million at the midpoint. We are also improving our full year 2023 adjusted EBITDA guidance range to negative $95 million to negative $115 million or by $100 million at the midpoint.

…

Moving on to our full year 2024 guidance. We are poised for a rapid increase in adjusted EBITDA due to continued strong revenue growth, coupled with a scaled fixed cost structure. For 2024, we expect revenue in the range of $4.5 billion to $4.8 billion or nearly $1 billion of incremental revenue growth compared to the midpoint of our fiscal 2023 revenue guidance and more than double our revenue from 2022.

Our guidance range for 2024 adjusted EBITDA is $350 million to $450 million, which equates to more than $500 million of year-over-year growth compared to the midpoint of our fiscal year 2023 adjusted EBITDA guidance and more than $1.1 billion of adjusted EBITDA improvement since 2022.

(Emphasis Ours)

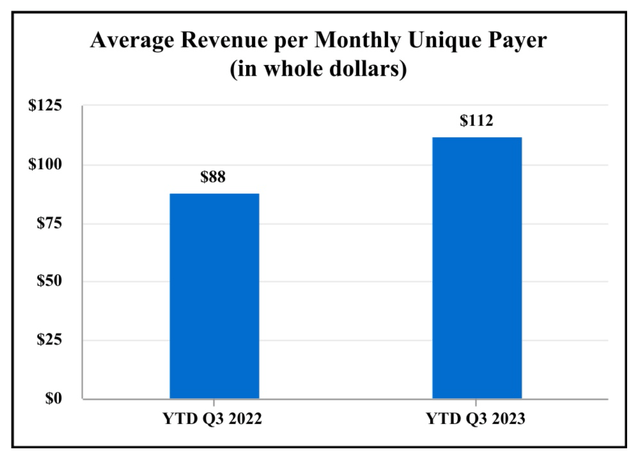

This guidance largely has to do with the increase in playing and engagement from users in mature jurisdictions, which has been trending in the right direction, and bodes well for future profitability:

As marketing spend goes down, fixed costs stabilize, and users and RPU continue to increase, it’s easy to see how management expects to materialize $400 million in EBITDA by the end of FY 2024.

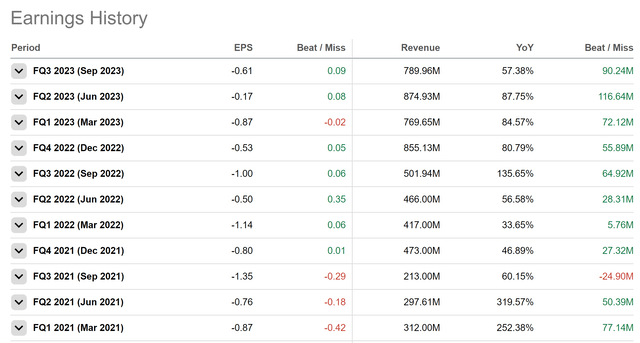

Looking forward to the next earnings report which is slated to come out in a couple of weeks, we see continued strength, and potentially a beat, in the cards. This is based on the company’s track record of beats, as well as the positive dynamics we have discussed, and management has emphasized:

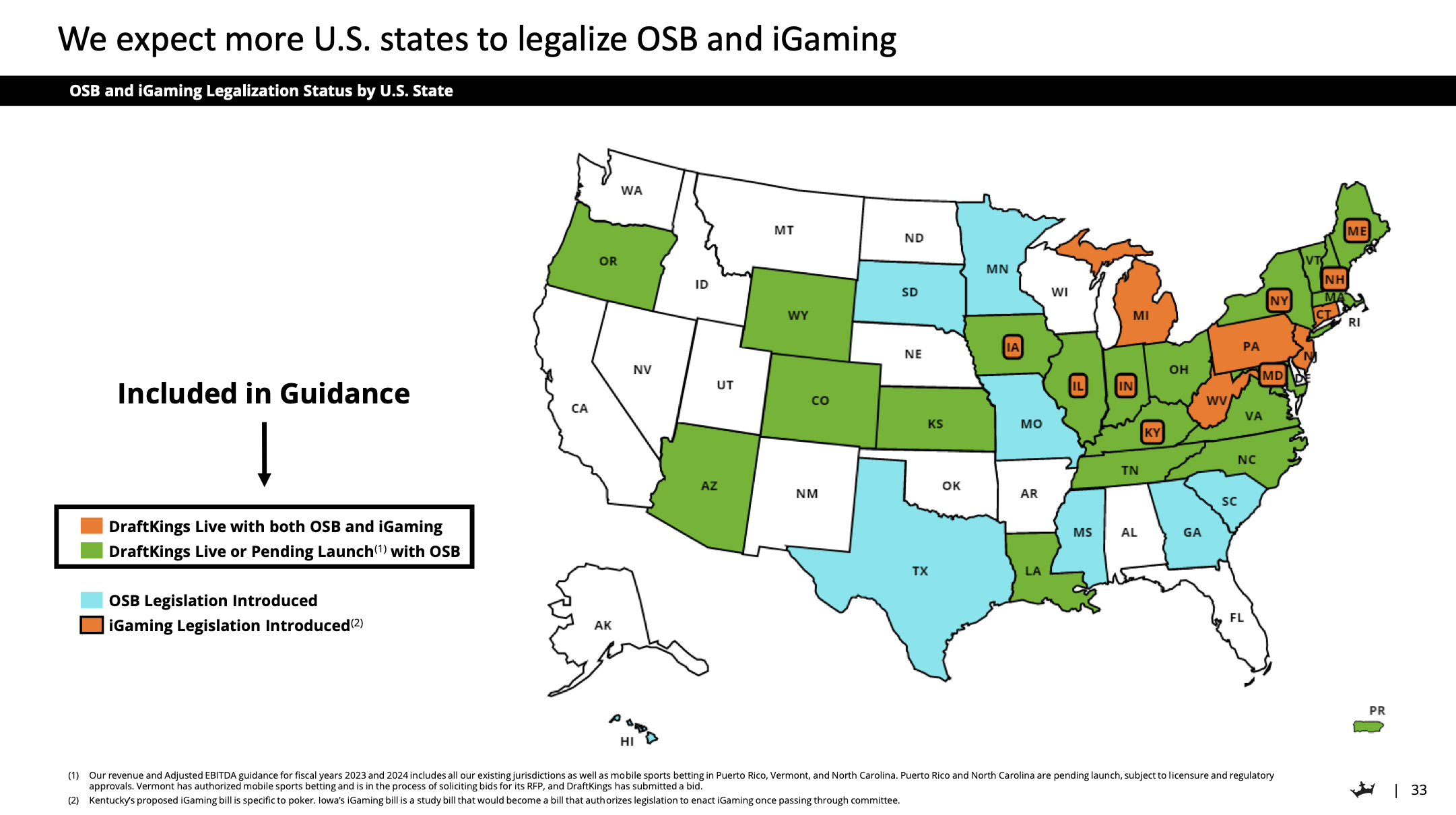

There’s a lot to be excited about here. Plus, we haven’t even talked about the potential for iGaming to grow & more OSB legalization:

Investor Presentation

Taken together, it’s an extremely exciting package.

But how much does it all cost?

Valuation

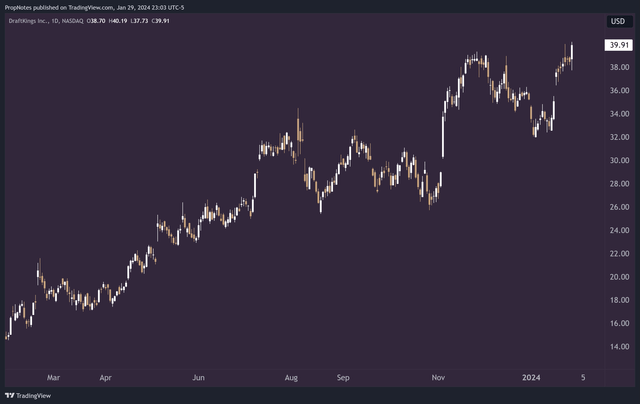

Fortunately, shares actually appear reasonable, despite rallying more than 150% in 2023:

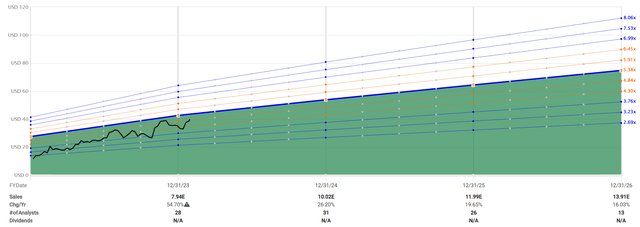

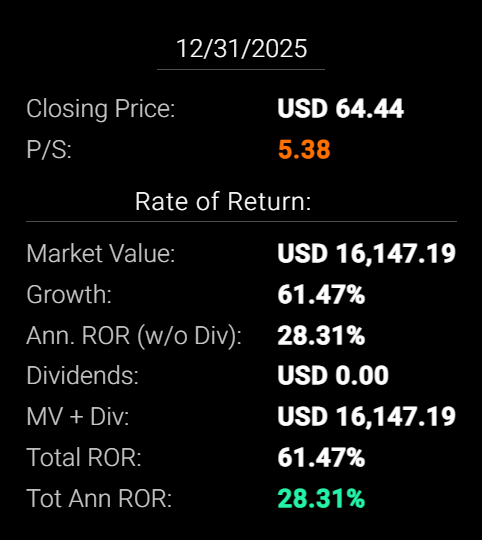

Nominally, shares have gotten more expensive, but even assuming zero multiple expansion on the sales front, realizing 28% annualized returns through the end of 2025 seems highly doable given the revenue growth rates alone:

FAST Graphs (Assuming 10k Invested) (FAST Graphs)

If baking in a bit of multiple expansion, or if looking at DKNG operating cash flow multiples, the potential for growth appears even greater, at 30%+ annualized returns through 2026:

This assumes a stable or growing valuation, but how likely is that?

In our view – very.

While DKNG has had crazy historical multiples in years past, the company’s 5x revenue multiple doesn’t appear to be expensive on a historical basis:

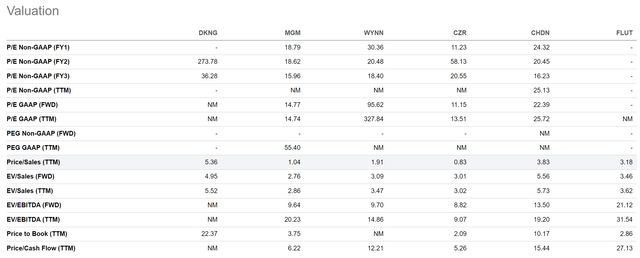

Versus peers in the space, DKNG does appear a little more expensive:

However, DKNG is also clearly the premium brand in the industry – it’s the one gaining the market share, and it’s the one willing to spend the most to be number one in new markets. With the profitability dynamics we’ve discussed, the premium to competitors here is ‘ok’ with us as investors.

All in all, the valuation is at a point where there’s a lot of room for returns on the top line growth as well as the cash flow we’re anticipating will come through to the bottom line.

Risks

While the growth looks very enticing and the valuation seems reasonable, there are a few key risks to keep in mind.

First and foremost, earnings are in a few weeks. It doesn’t matter that we think the company will beat – it all depends on how the market reacts to what is reported. There’s a risk here that the market will react badly to whatever management says. Unless something very unexpected happens, this doesn’t hurt our view of the long-term potential of the company. That said, it could cause a lot of short-term volatility.

Additionally, other risks stem from the regulatory burdens involved in real-money gaming. If DKNG runs afoul of regulatory mandates and procedures, then a loss of licensing or other annoyances could crop up and materially impact the business. DKNG have been crisp operators thus far and have the technology to scale in a compliant way, but it’s a risk worth having in mind.

Finally, DKNG has a number of legal disputes outstanding, vs. a number of different parties, including the Attorney General of Texas, a gaming company alleging patent infringement, and a bettor on the platform that lost money due to the suspended Bengals – Bills game last year where Damar Hamlin collapsed on the field.

While the last one doesn’t represent an existential risk to the company, negative surprises could cost the company and hurt DKNG’s brand, which may cause headwinds for new user growth down the line.

Summary

Despite the risks, DKNG’s compelling package of maturing user monetization, new user growth, and improving unit economics gives the stock ample runway to provide investors at this point solid returns.

The undemanding valuation, at only 5x sales, further buttresses our thesis.

Thus, our “Strong Buy” rating.

Stay safe out there!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DKNG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.