Pfizer Is Down 54% From Highs, Now Yields 6.1%

Summary:

- Pfizer Inc. stock has experienced a significant decline from its all-time high to the lowest price in over 10 years.

- Despite lower sales from its COVID-19 vaccines, Pfizer’s other revenues grew 7% YoY in FY 2023.

- The decline in vaccine sales presents an opportunity for Pfizer to reinvest in research and development and develop new profitable products, which the market isn’t appreciating.

- How low can it go? Should you buy, sell, or what?

Michael M. Santiago

Written by Sam Kovacs.

Introduction

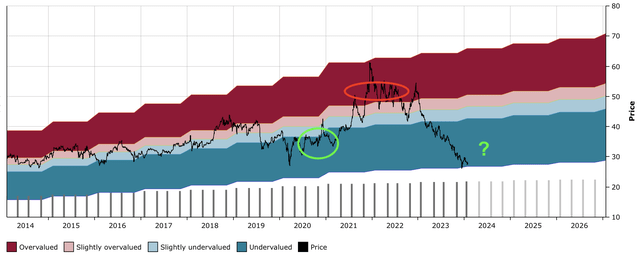

The pendulum of the market always swings. In just 2 years, Pfizer Inc. (NYSE:PFE) has gone from its ATH to the lowest price it has recorded in over 10 years.

We’ve been watching it all come down, as by the time February 2022 hit, we had sold all of our Pfizer position, after having accumulated it in 2020 prior to the vaccine announcement (source here and here).

When in December 2021, we said selling PFE was a good idea, this was met with quite a bit of criticism:

Selling PFE right now would be foolish – a superb company firing on all cylinders, with plenty of room left to run in its boom.

Why would you sell the quality blue-chip portfolio constituents and incur the cap gain tax?

Because capital gains tax will never be quite as bad as losing 50% of the market value of your position.

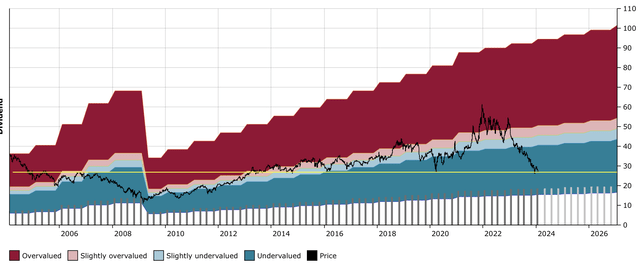

PFE DFT Chart (Dividend Freedom Tribe)

“Buy Low, Sell High, Get Paid To Wait” is our investing motto.

But the Covid money came and went, and with it the popularity of Pfizer’s stock.

Despite the fact that its business generates more money each quarter on both top and bottom lines than in any pre-Covid period, the price is now below levels seen in the past decade, as the optimism over the company’s profitability has now reversed and reached peak pessimism.

“Surely this must be the bottom” is something investors must be thinking as they look at Pfizer’s stock.

Maybe, maybe not. I have no crystal ball.

In this article, I’ll briefly review Pfizer’s FY 2023 results, present an angle nobody seems to be discussing, answer the pressing question “how low can it go,” and offer my suggestion to dividend investors.

FY 2023 in review

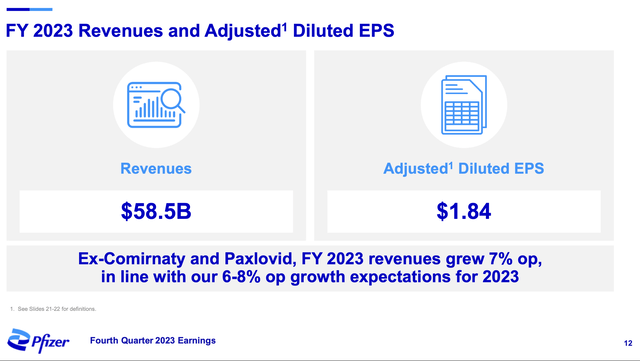

The headline says that revenue for the year was down 41%, entirely due to lower sales from their Comirnaty vaccine and Paxlovid program.

In fact, they even reported negative $3.5bn in revenues from Comirnaty, as the U.S. government gave back a bunch of meds it didn’t need.

Despite this, the rest of the company’s revenues grew 7% YoY.

2023 revenues were $7bn higher than in 2019, or a 3.4% CAGR over the 4-year period.

Not great, but clearly not awful. If we exclude the non-cash Paxlovid revenue reversal, then the revenue would have grown at 5% per year, which is now looking good for a company like Pfizer.

Everyone is so concerned with Pfizer’s revenues declining due to its vaccines no longer being sold.

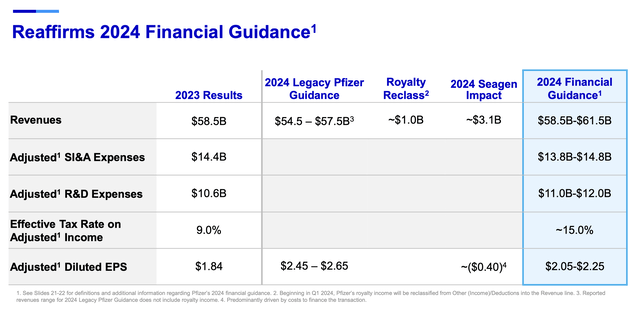

Sure the optimism bubble burst, but Pfizer is not really a $100bn revenue company (what it raked in during 2022), it is a $60bn revenue company.

Is this enough to justify a 6.1% yield on the stock?

The obvious Covid gift

Many investors see the decline in vaccines and Covid-related sales as a shame. They got a bit too excited a couple of years ago that everyone would need a couple of courses of the jab a year. Turns out this is not the case.

They made $37bn from the product nonetheless. One of the most successful products ever.

This is a blessing, even if it’s gone now, because of the feedback loop of Pharma profits -> R&D -> Pharma profits.

How does this work?

The feedback loop created by blockbuster drugs like Pfizer’s Comirnaty platform is a classic example of how success in one pharma product can fuel further research, leading to additional profitable products and ongoing investment in innovation. Here’s how this cycle typically works:

-

Initial Success and Revenue Generation: A blockbuster drug like Comirnaty generates significant revenue for the company. This high level of income is particularly notable for products that address widespread or urgent medical needs, as was the case with the COVID-19 vaccine.

-

Reinvestment in Research and Development (R&D): A portion of the revenue from the blockbuster drug is reinvested into R&D. This reinvestment is crucial for the discovery and development of new drugs. Pharmaceutical R&D is expensive and time-consuming, often requiring significant upfront capital to cover the costs of preclinical studies, clinical trials, regulatory approvals, and other research-related expenses.

-

Discovery and Development of New Drugs: The increased investment in R&D can lead to the discovery and development of new drugs. This stage involves identifying new drug candidates, conducting preclinical and clinical trials, and navigating regulatory processes. Successful outcomes in this stage can result in the creation of new, effective treatments for various diseases.

-

More Profits from New Products: If the new drugs developed through reinvested funds are successful, they can themselves become profitable products. These new drugs can address different therapeutic areas or improve upon existing treatments. The profits generated from these drugs can be substantial, especially if they meet previously unaddressed medical needs or offer significant improvements over existing therapies.

-

Continuation of the Cycle: The profits from these new drugs can then be reinvested back into R&D, perpetuating the cycle. This ongoing reinvestment allows the company to continuously innovate and maintain a pipeline of new drug candidates, which is essential for long-term success in the pharmaceutical industry.

Don’t believe that the pharma model has this feedback loop?

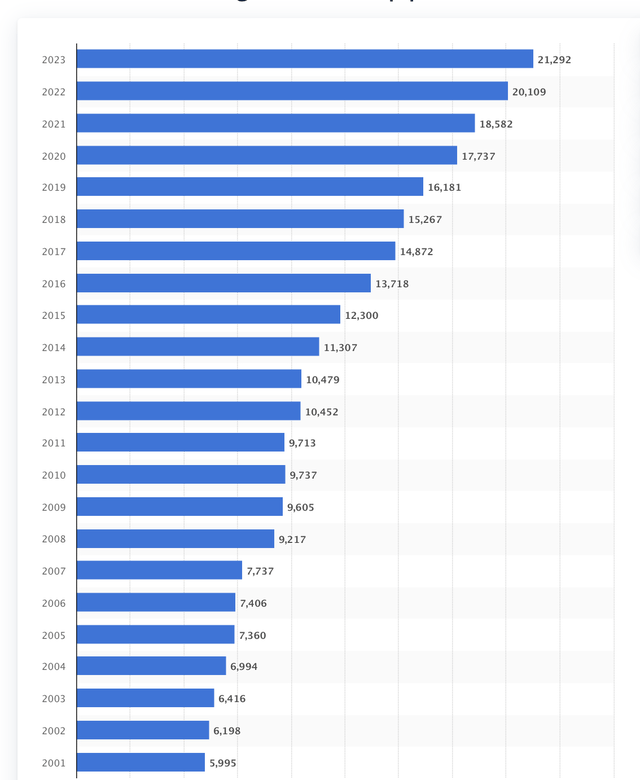

Total number of drugs in the R&D pipeline worldwide from 2001 to 2023 (Statista)

Then why does the number of drugs in the worldwide research pipeline increase every year? Rhetorical question.

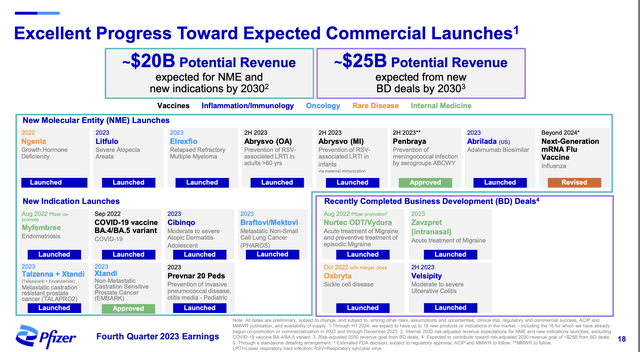

It is such success which allows PFE to also acquire companies like Seagen, and further increase their moat and dominance, notably in Oncology.

So while the Cominarty business is likely to continue declining and end up fizzling out, the new platforms will support growth. In 2024, EPS should be up 10% from 2023.

These launches should continue to increase PFE’s revenues and profits for years to come, and a blockbuster drug will aid in that respect.

How low can it go?

So PFE’s business isn’t in jeopardy, but when you look at the market’s reaction, it seems that the market would rather have a situation where the vaccine never existed.

The thing is, when asking the question of how low can it go, one must remember the John Keynes quote:

“The market can remain irrational longer than you can remain solvent.”

Of course, as dividend investors, we will not put ourselves in a situation of being insolvent, but we might be underwater longer than is comfortable, or good for our performance numbers.

Doesn’t matter if we’re getting paid to wait ultimately, but the question needs to be asked and answered.

The answer to the question “how low can it go?” is hard.

PFE 20 Year DFT Chart (Dividend Freedom Tribe)

The $26 level has provided good support in the past, namely in 2020, 2016, and 2014, and has been resistance in 2005 and 2006.

If it breaks below, $22 or even $20 is a real possibility. Will this happen?

Repeat with me: I DON’T KNOW THE FUTURE.

However, to answer the question “can it go lower?” is easy: the answer is always yes.

If it hasn’t hit $0 yet, it can go lower.

Buy, Sell, what now?

At a 6% yield, it should make intuitive sense that if PFE can keep its business stable as the Covid vaccines’ sales eventually fizzle out and then grow, then it can continue paying its dividend, and therefore it would be a good pick for patient dividend investors.

I always look at management’s prepared remarks to see if there is any mention of the dividend policy. An omission to discuss the dividend policy also sends a strong message. This is what CEO Albert Bourla had to say this year (emphasis added):

As discussed in prior quarters, our capital allocation strategy is designed to enhance shareholder value and is based on three core pillars: growing our dividend, reinvesting in the business, and making share repurchases after delevering our balance sheet.

For 2023, we:

Returned $9.2 billion to shareholders via our quarterly dividend;

Invested $10.7 billion in internal R&D;

And, invested approximately $44 billion in completed business development transactions, net of cash acquired, essentially all for the acquisition of Seagen

Our expectation is to maintain and grow our dividend while de-levering our capital structure-with a gross leverage target of 3.25x and a goal to preserve our credit rating and access to Tier-1 commercial paper.

I believe that while the delevering happens, the dividend will increase at a very low rate, token increases.

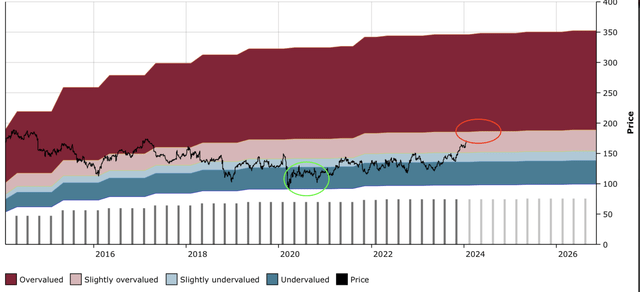

The whole situation reminds me of IBM (IBM). IBM was undergoing a transition in the past decade, which saw its stock decline in slow-motion trainwreck fashion from 2015 to 2020. Then it hobbled in a closed range between 2020 and 2023, before recently taking off.

IBM DFT Chart (Dividend Freedom Tribe)

Had we bought in 2016 following the initial decline, we would have waited for a long time before seeing sizeable gains which we would have realized.

The gains materialized quickly.

So here is my take on Pfizer:

Chasing it on the way down can take a long time to play out. I’d suggest being slow in establishing a position. PFE is arguably a good long-term buy all the way up to $33.

I’d enter the position in multiple increments (as we always do) but with half the weights we usually do.

If this is the bottom, great.

If it’s not the bottom, we’ll add more.

Entering this position comes with the implication that we are willing to get paid to wait for a while before the price jumps up.

We’re not trying to time a reversal here, we’re looking for a good long-term entry point into Pfizer Inc. stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE, IBM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to Buy Low, Sell High & Get Paid to wait…

The first thing you want to do is hit the orange “follow” button, so we can let you know when we write more dividend related articles.

But if you want the best experience, join the Dividend Freedom Tribe!

Our model portfolios are ahead of the market, and our community of nearly 900 members is always discussing latest developments in dividend stocks.

Our model portfolios are ahead of the market, and our community of nearly 900 members is always discussing latest developments in dividend stocks.